Accounting: Accounting: Actions: Tax Lock Dates

Purpose

This document covers the configuration of Tax Lock Dates in the Accounting application of Odoo 16. A Tax Lock Date will move any new transactions and its tax values, whose accounting date is prior to the date set, to the next open tax period. This is to ensure that no changes can be made to a report once its period has closed.

Good to know!

It is recommended to lock your tax date before working on Closing Fiscal Period to End the Year to ensure that other users can not modify or add transactions that would otherwise have an impact on the closing journal entry, which will help avoid some tax declaration errors.

Process

To get started, navigate to the Accounting app.

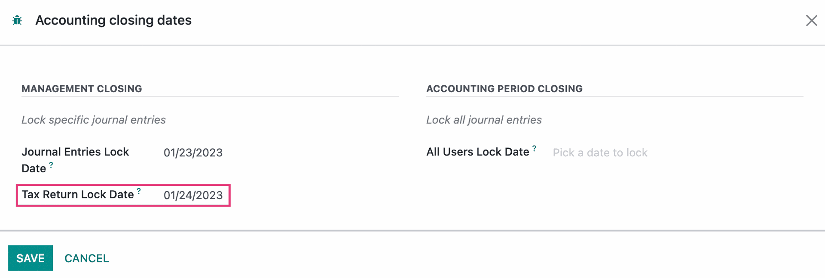

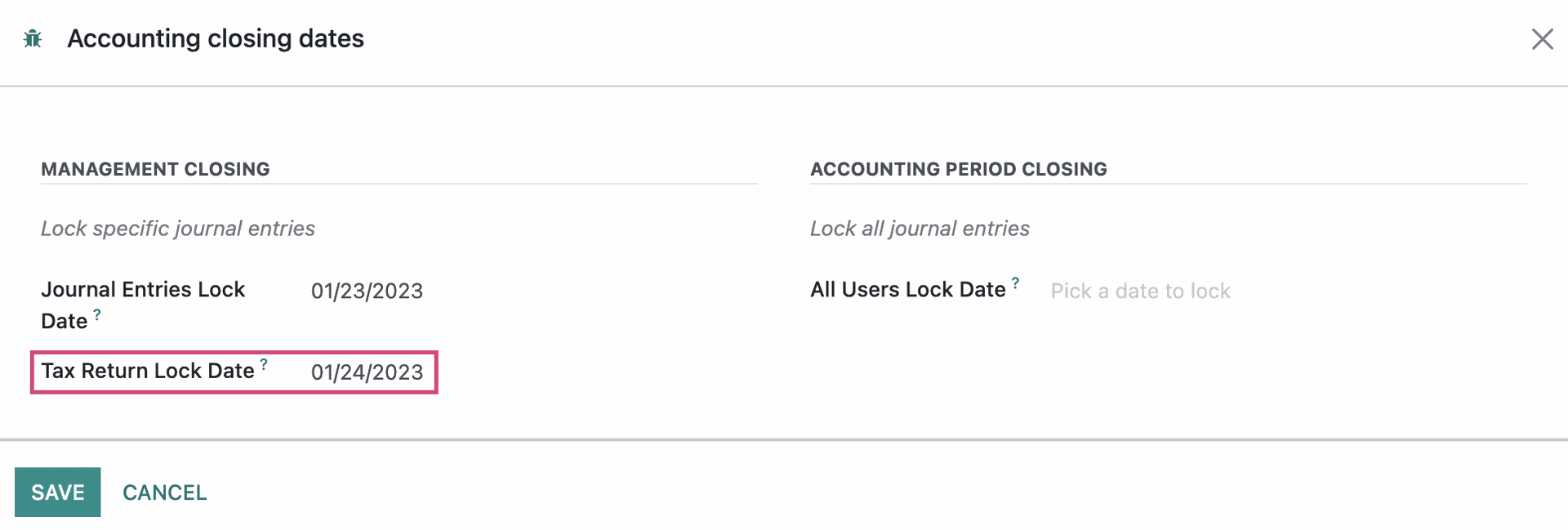

To set your lock dates, go to Accounting > Actions >Lock Dates .

Managment Closing Lock Specific Journal Entries

Journal Entries Lock Date: This prevents users, except Advisors, from creating Journal Entries prior to the defined date for all users.

- Tax Return Lock Date: This prevents modifications to Tax Returns prior to the defined date (Journal Enties involving taxes). The Tax Return Lock Date is automatically set when the corresponding Journal Entry is posted. (Continue reading to see an example of that functionality.)

Accounting Period Closing Lock all Journal Entries

All Users Lock Date: This prevents Journal Entry creation or modification prior to the defined date for all users. As a closed period, all accounting operations are prohibited.

Click SAVE when finished.

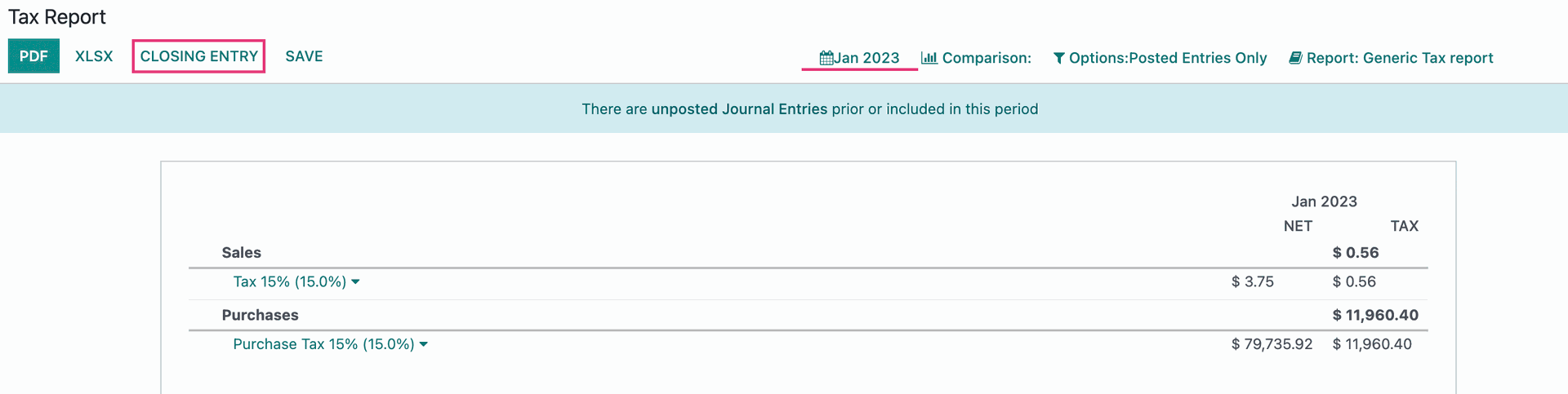

Odoo will automatically set the Tax Return Lock Date for your when you post a Tax Return's Closing Entry in, Reporting >AUDIT REPORTS > TAX REPORT .

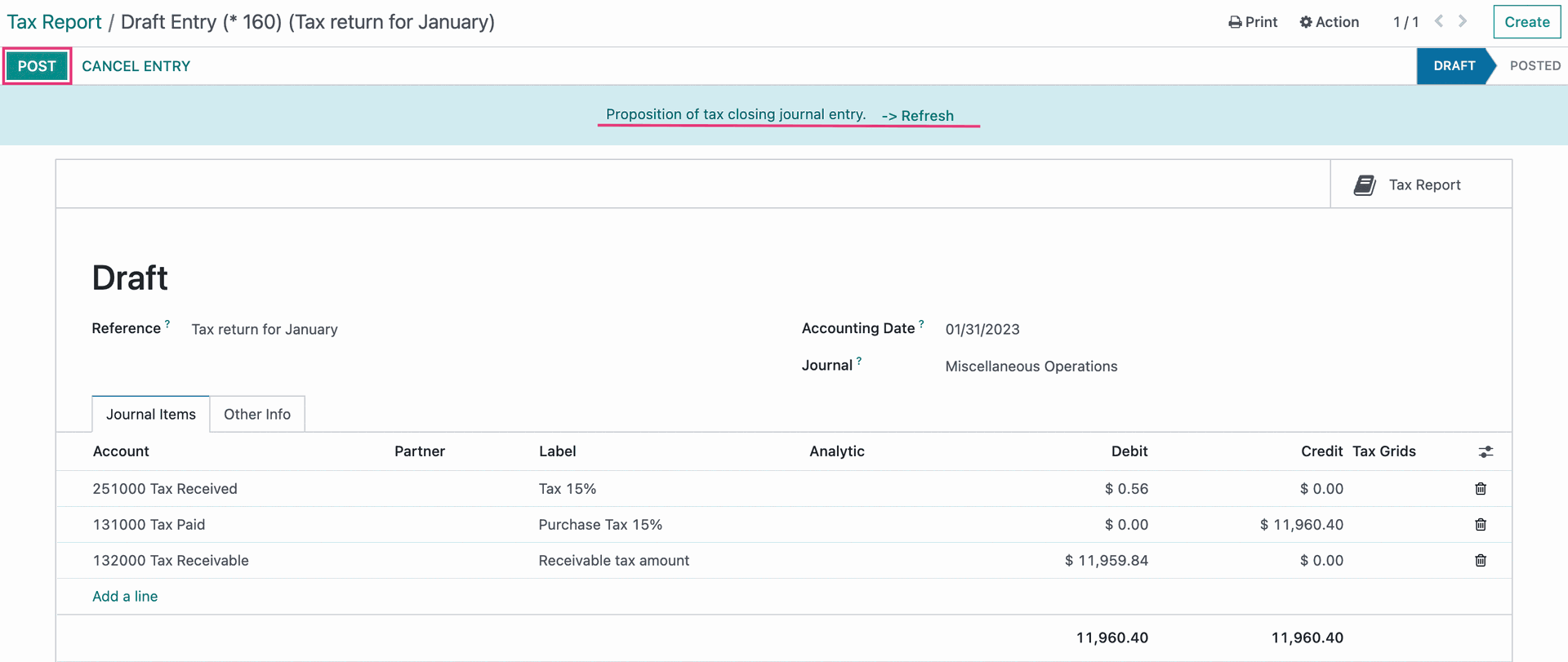

Review the report and if everything is correct and you'd like to move on to making a closing journal entry for the tax return, click the CLOSING ENTRy button.

This opens a new window for the related Journal Entry the system automatically creates based on the taxes in the period. A blue bar will also be on the screen, that allows you to click -> Refresh to include any new entries made since you began the Closing Entry process.

Review the entries, then click POST to complete the process, which automatically updates the Tax Return Lock Date to the last day of that month.

The image below shows the result of posting the Closing Entry from the Tax Report for the month of January 2023.

Good to Know!

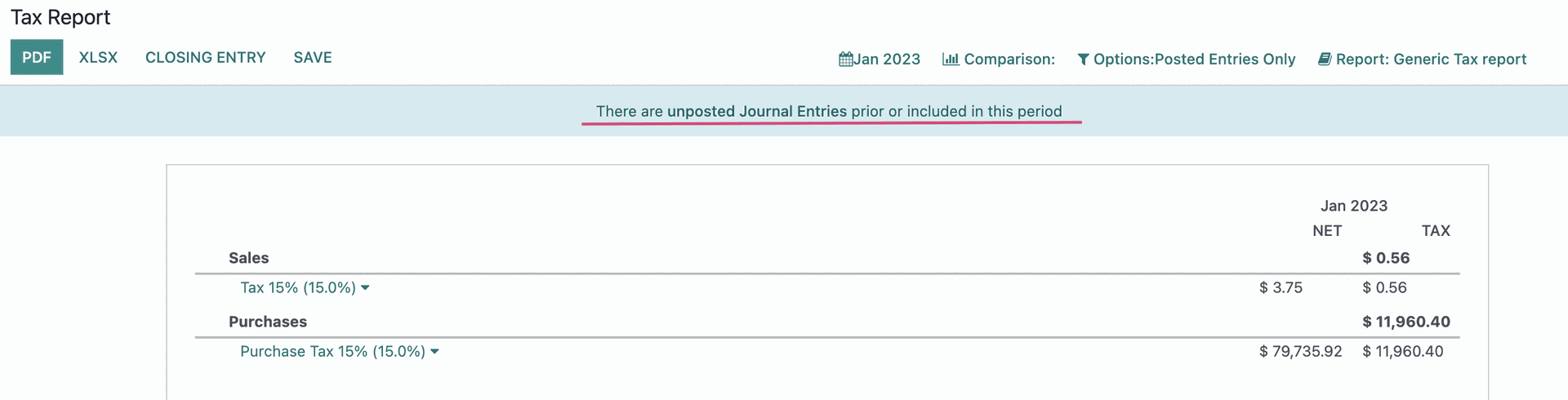

Watch for warnings about Unposted Entries.

Keep alert during the process for warnings Odoo displays for you about unposted entries in (or before) the tax period you are working to close.

You can see one of those warnings in the example of the Tax Report below. It is in the blue bar. If you click on the text in bold that says "...unposted Journal Entries...", you will be taken to a list of those Journal Entries where you can investigate, then determine what to do with them. Note that this is only a warning nd you will be able to continue posting the entry generated by the Time ax Report and changing the Tax Return Lock Date.