Hibou Odoo Suite: Payroll Modules: US Payroll

Repository Versions:

Modules:

OPL-1

Important!

Hibou Payroll + Odoo Compatibility

Due to the changes made in Odoo Accounting at version 13, Hibou's Payroll module is only compatible with Enterprise after version 13. It is still compatible with pre-13 versions of Community.

Purpose

The purpose of this documentation is to outline the use case and processes associated with Hibou's USA Payroll module for Odoo. The USA Payroll module includes all of the calculations and contribution registers needed for the United States Federal Tax Payment System.

Getting Started

First thing's first, we want to install the module! Navigate to the Apps Application and search 'USA - Payroll". When ready, hit Install.

Good to Know!

The US Payroll module requires the Odoo's Payroll application. However, if you do not already have this application installed, Odoo will install it for you during this module's installation!

Processes

To get started, navigate to the Employees application.

Configuring an Employee Contract

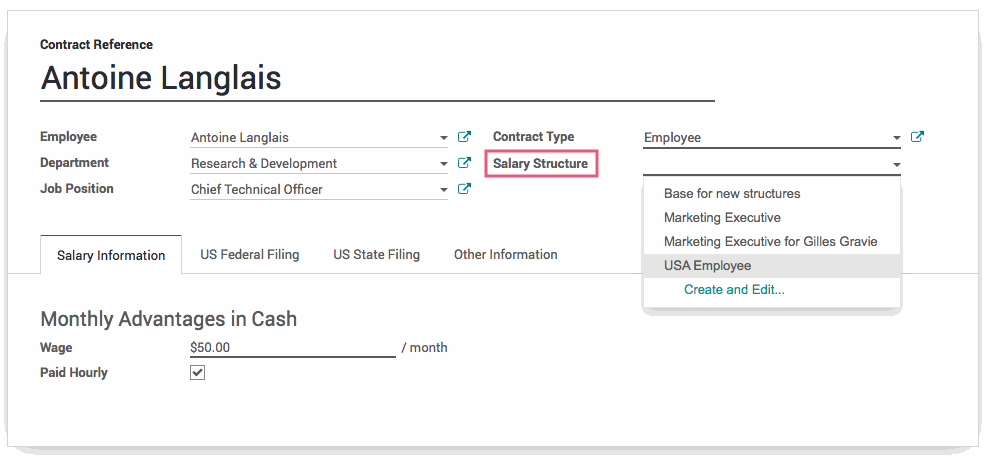

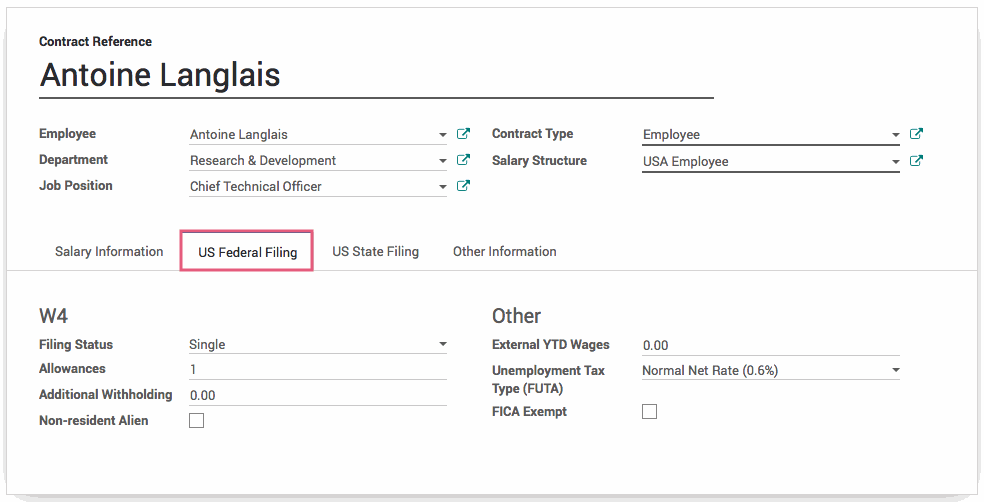

After selecting USA Employee for the contracts Salary Structure, click on the US Federal Filing tab. Fill in the following fields, which are found on the employee's completed W4 form:

Filing Status: Found on line 3 of the employee's completed W4 form.

Allowances: Found on line 5 of the employee's completed W4 form.

Additional Withholding: Found on line 6 of the employee's completed W4 form.

Non-resident Alien: Check this box if the employee is classified as a non-resident alien.

External YTD Wages: Wages that have been already been paid out to the employee this year via another payroll system. These external wages are used in calculating various caps.

Unemployment Tax Type (FUTA): Select Exempt, Normal Net Rate or Basic rate.

FICA Exempt: Check this box if the employee is exempt from paying FICA tax in the United States.

When finished, hit save .

Important!

Ensure that the status of the contract is Running. A contract that is not Running cannot be used during payroll. To change this, simply click 'Running' in the status bar on the contract.

Running US Payroll

Navigate to the Payroll application.

Important!

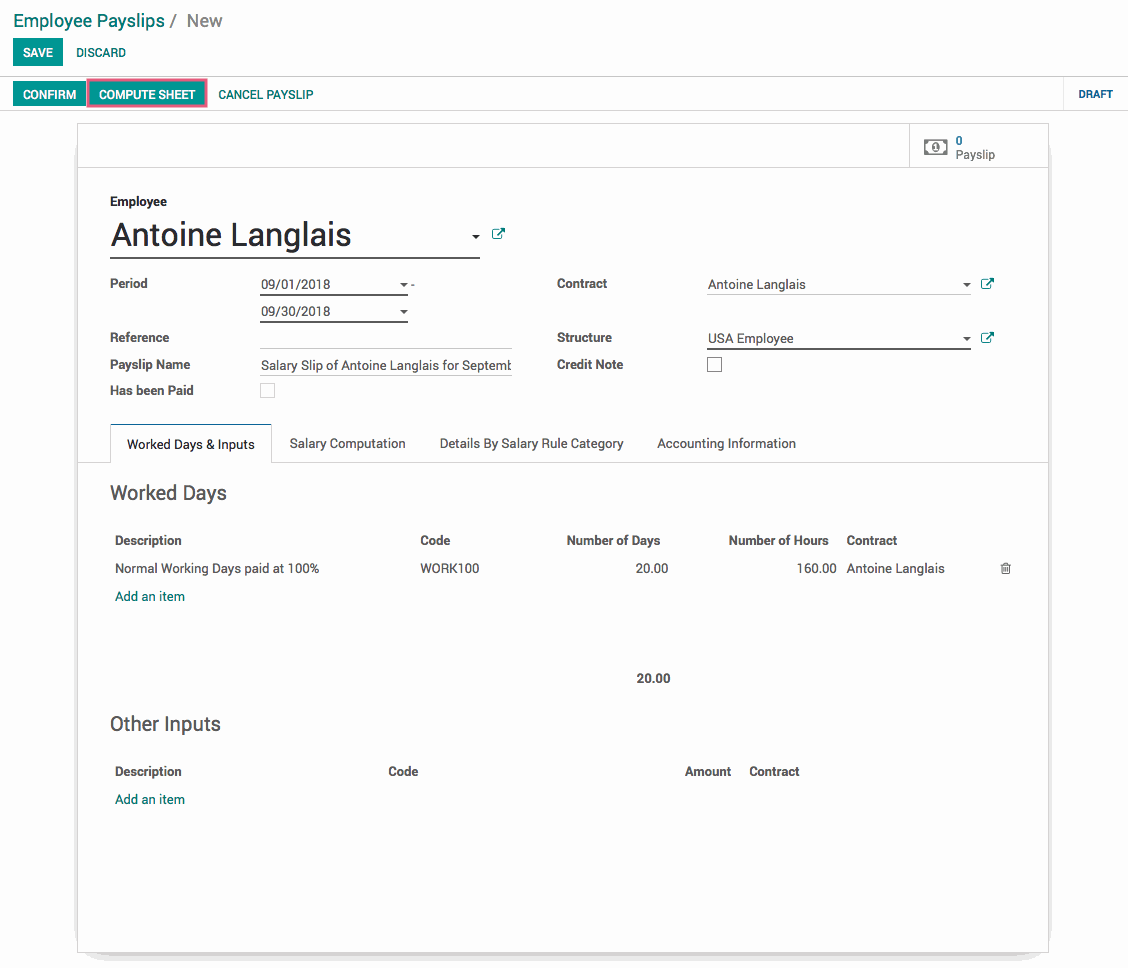

You must enter dates for the pay period, in the Period fields, before you select an employee. After selecting an employee, you will be unable to change the Period.

Click CREATE to create a new payslip. Select the employee with the configured contract from the dropdown menu. When this field is selected, the following will automatically be filled in:

Contract

Structure

Payslip Name

Additionally, a worked days line will be created.

After the employee has been selected, click Compute Sheet .

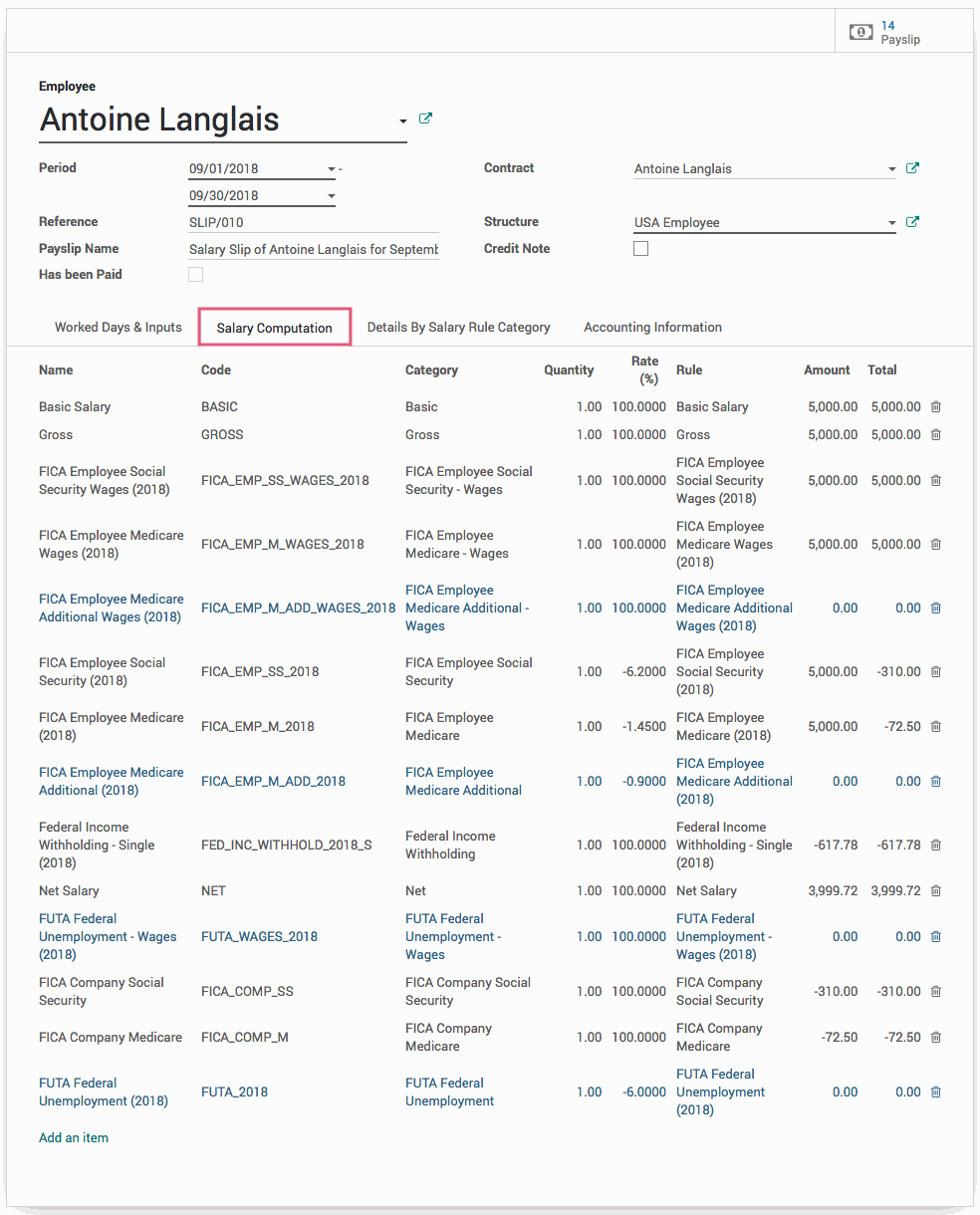

In the Salary Computation tab we can see all of the US Federal tax computation totals.

Once the payslip has been confirmed, hit save .

Technical

This module includes contribution registers and partners for:

The Electronic Federal Tax Payment System (EFTPS) - Form 941

The Electronic Federal Tax Payment System (EFTPS) - Form 940

The Electronic Federal Tax Payment System (EfTPS) - Form 941 (FICA + Federal Withholding)

The Electronic Federal Tax Payment System (EFTPS) - Form 940 (FUTA)

Additionally, it includes a variety of contract-level calculations:

FICA Social Security

FICA Employee Medicare

FICA Employee Medicare Additional

Federal Income Withholding

FICA Social Security

FICA Medicare

FUTA Federal Unemployment