Purchase: Purchase Workflows: Over-receiving Product

Purpose

The purpose of this documentation is to explain how to over-receive a product and how this "free" product affects your stock valuation.

Process

To get started, navigate to the Purchase app.

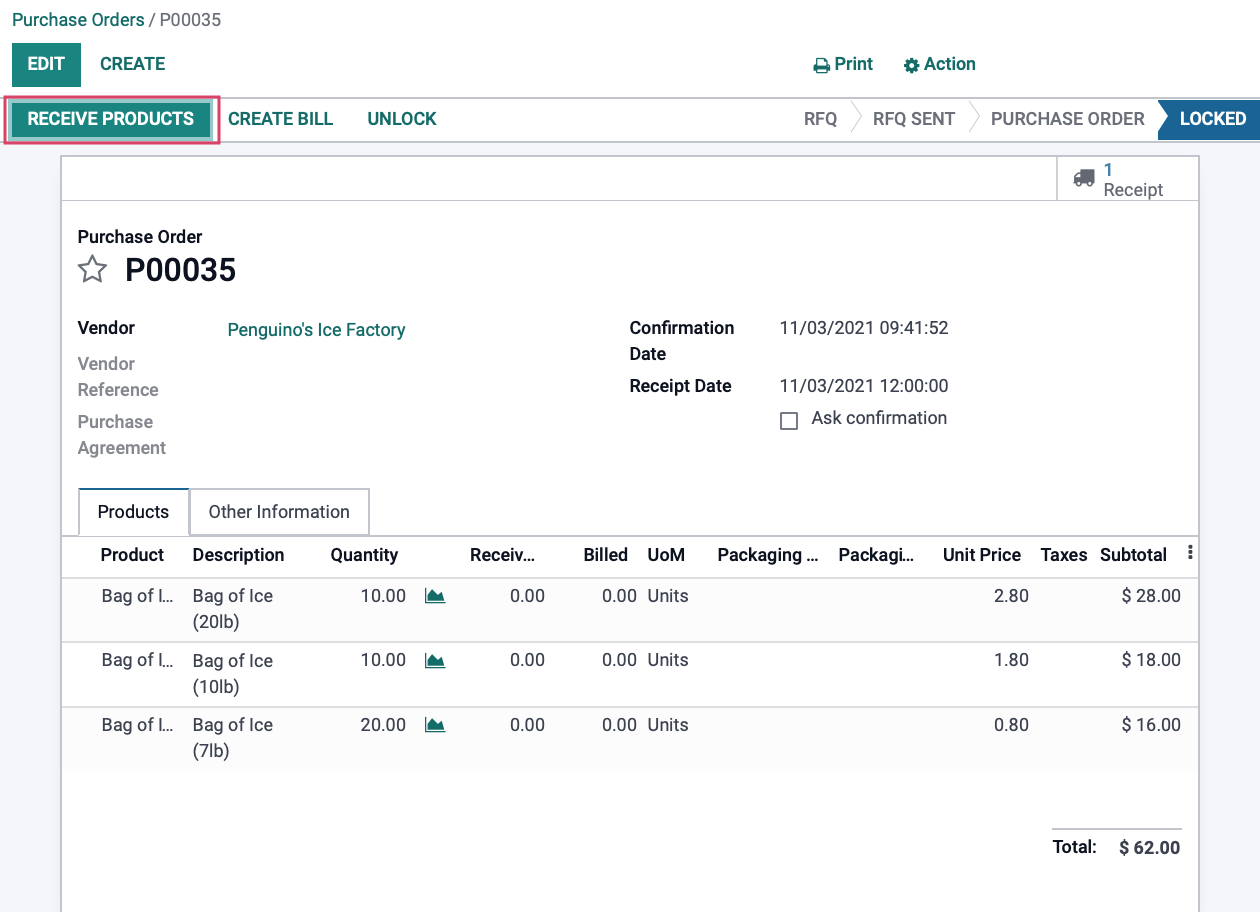

Once there, go to ORDERS >PURCHASE ORDERS. Find and select the purchase order where you will be receiving your products. On your Confirmed purchase order, click the RECEIVE PRODUCT button.

Good to Know!

Accessing Ready Transfers

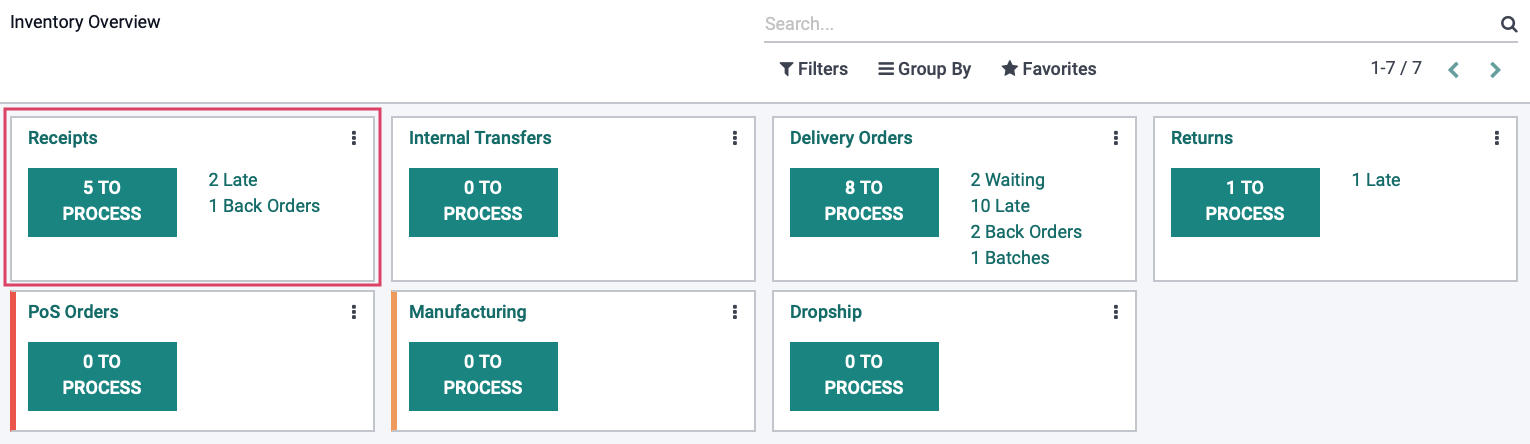

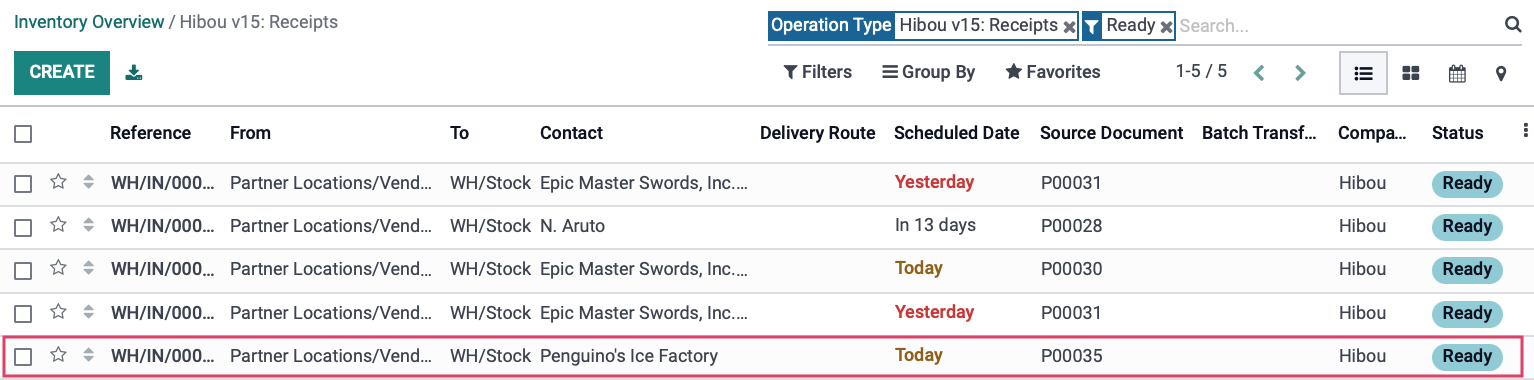

It is important to know that the Receipts can also be accessed through the Inventory application under OVERVIEW in the Receipts kanban card. Within this card, click the # TO PROCESS button to access all ready deliveries.

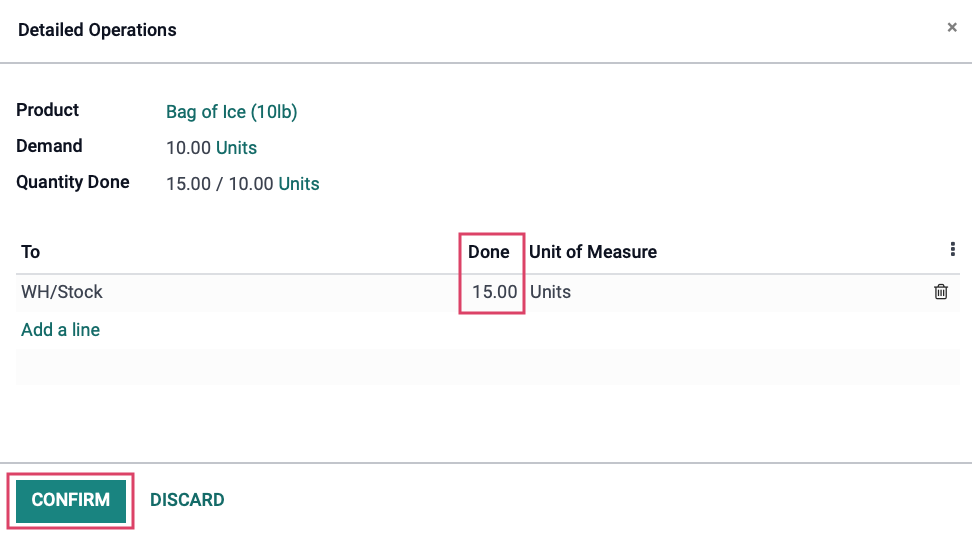

Click on the Detailed Operations button on each product line. This will open a popup window that will allow you to indicate your done quantities for each product.

![]()

Scenario

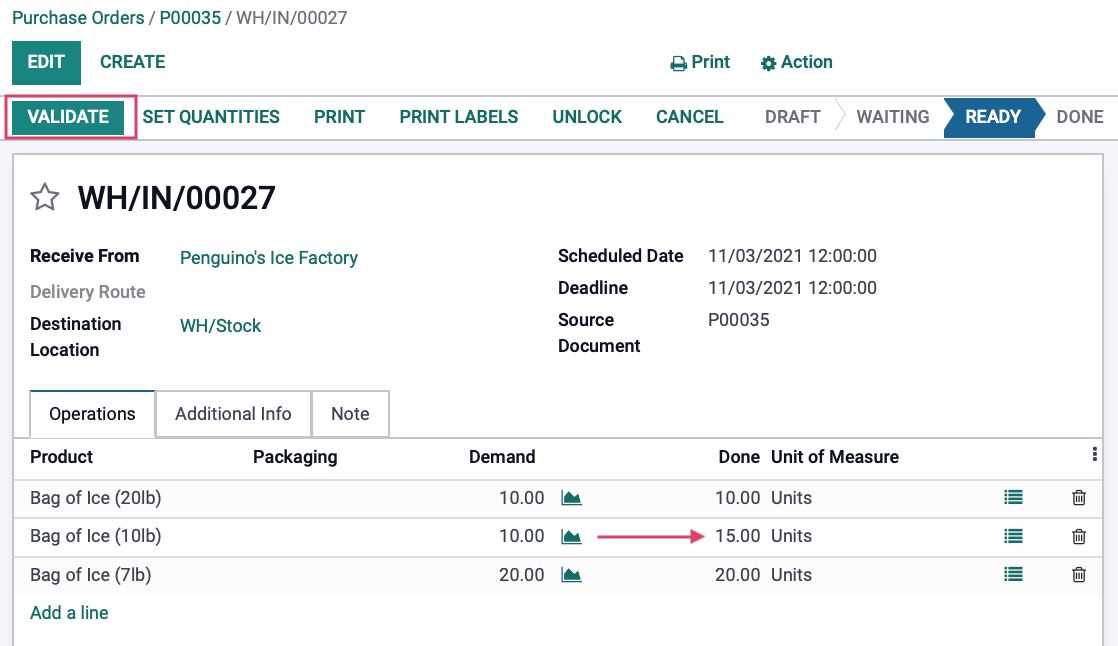

We just received our shipments of ice; however, Penguino's Ice Block Factory has sent us more product than originally asked. We notified them of the error, and they decided it was more trouble to have us ship them back. That means we'll keep the extra at no charge!

Let's fill out our receipt accordingly:

Bag of Ice (20lb) - Received 10

Bag of Ice (10lb) - Received 15 (5 more than anticipated)

Bag of Ice (7lb) - Received 20

Fill in the Done quantities column with the total amount you have received from the shipment, then click Confirm. Repeat this process with all your product lines.

As you can see, we have received 5 extra Bags of Ice (10lb). Verify that all your amounts are represented correctly, then click Validate.

How does a "free" product purchase affect your stock valuation?

Let us go ahead and take a look at how our inventory valuation is affected by receiving "free" product for each type of costing method that can be configured on the product's category.

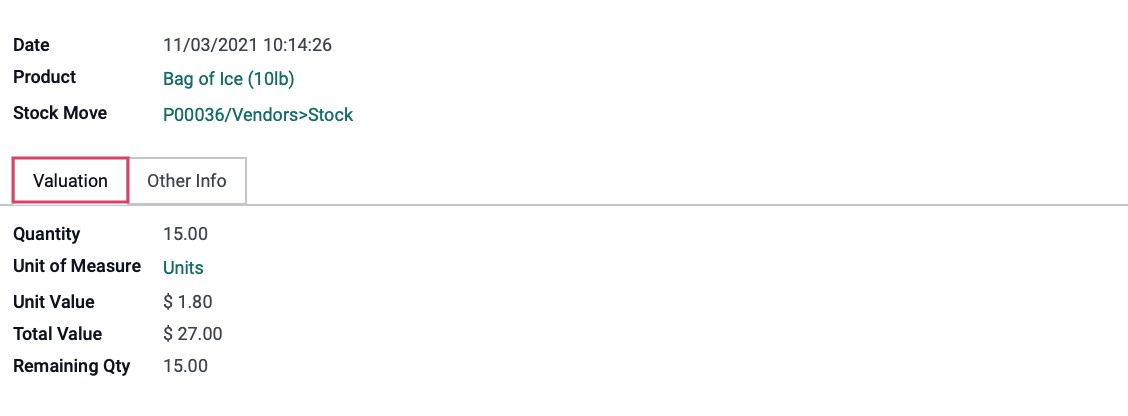

Standard Price

Your Inventory Valuation total for this product is sitting at $27 after receiving 15 products at $1.80 each. This means that it added the value of the products to your valuation regardless of them being "free" or not.

If you look back to the product, you will notice that the cost on the product did not changed. This is because a product with the costing method of standard price means that neither sales + deliveries nor purchase + receipt will impact the product cost or inventory valuation since this is set manually.

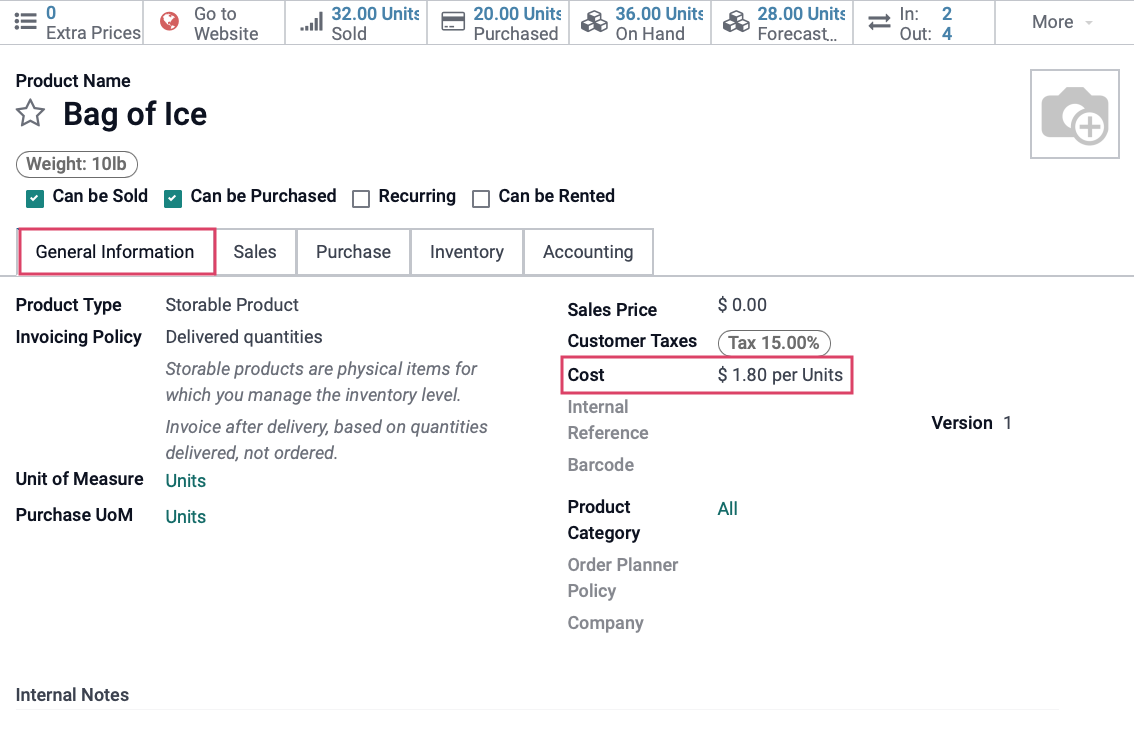

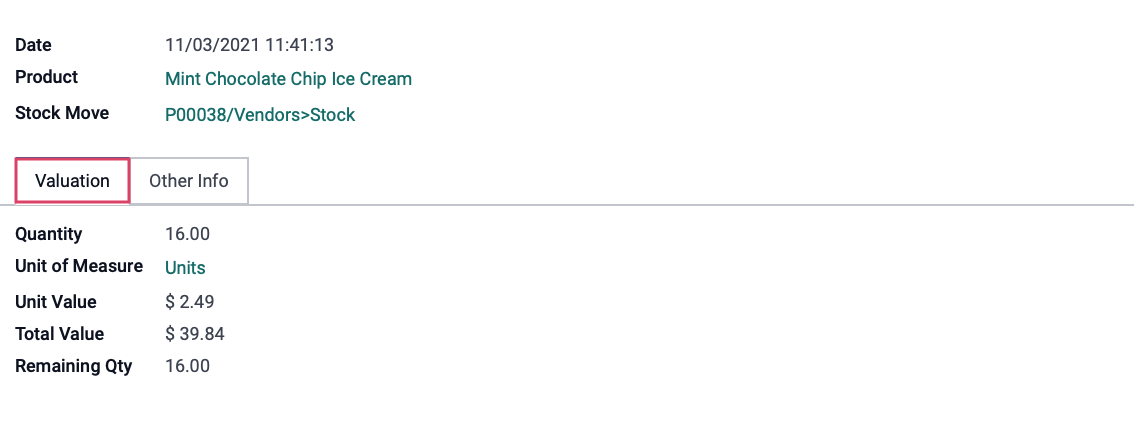

Average Cost (AVCO)

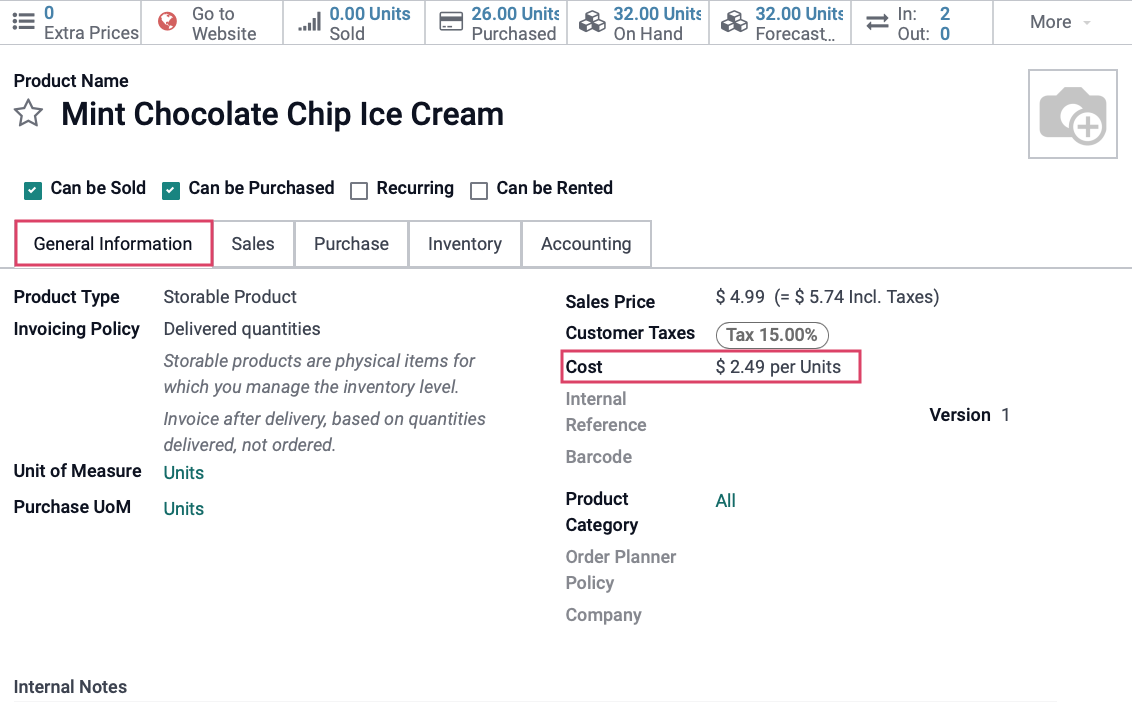

Your Inventory Valuation total for this product is sitting at $39.84 after receiving 16 products at $2.49 each, from a purchase order where we should have only received 10. Like the costing method: Standard Price, your products are valued regardless of them being "free" or not.

If you look back to the product, you will notice that the cost on the product has updated accordingly. This is because a product with the costing method of Average Cost means that both sales + deliveries and purchase + receipt will impact the product cost and inventory valuation.

First In First Out (FIFO)

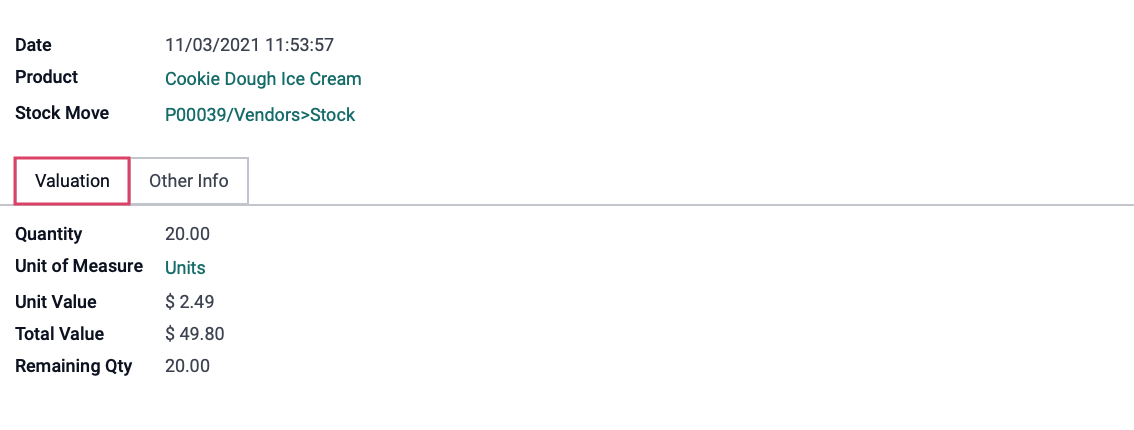

Your Inventory Valuation total for this product is sitting at $49.80 after receiving 20 products at $2.49 each when we only ordered 15. Like the other costing methods, your products are valued regardless of them being "free" or not.

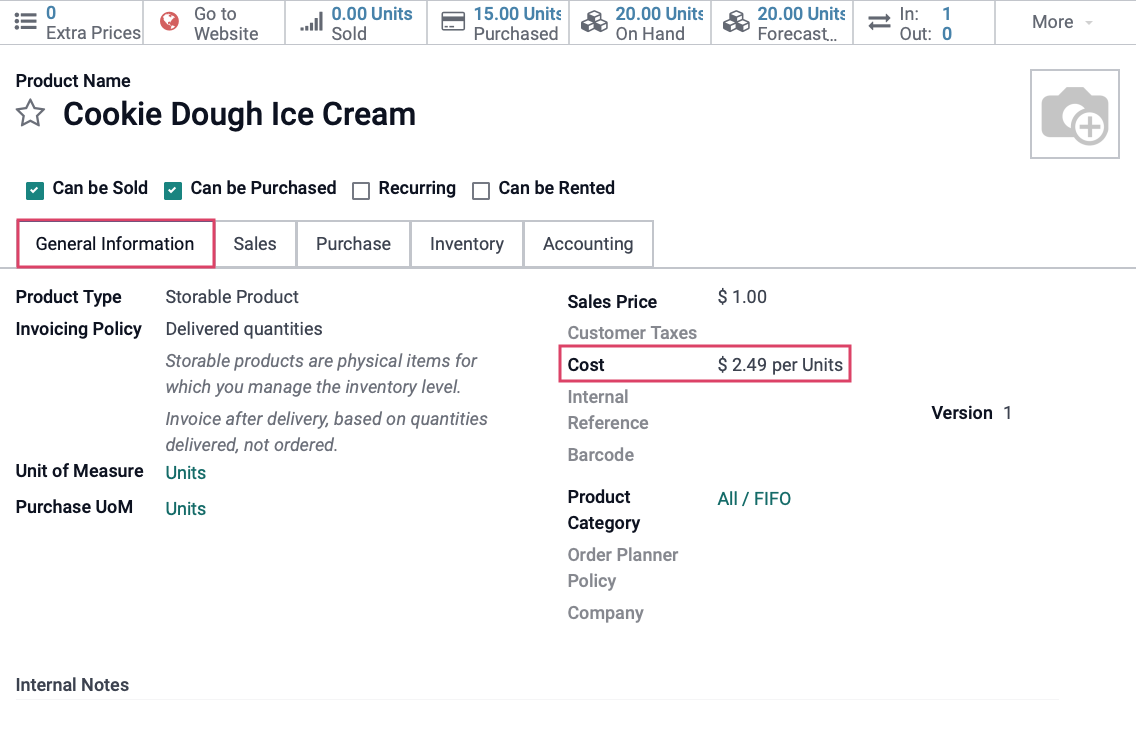

If you look back to the product, you will notice that the cost on the product has updated accordingly. This is because a product with the costing method of First In First Out means that the purchase + receipt will only impact the cost of the product if product stock was at 0 before receiving more. (This happens to be our case)

Otherwise, the cost will only be impacted during Sales + Delivery when the first group of received products at certain price all get sold. Once they have all sold from that group, the cost will update to match the unit cost of the next batch of received products.

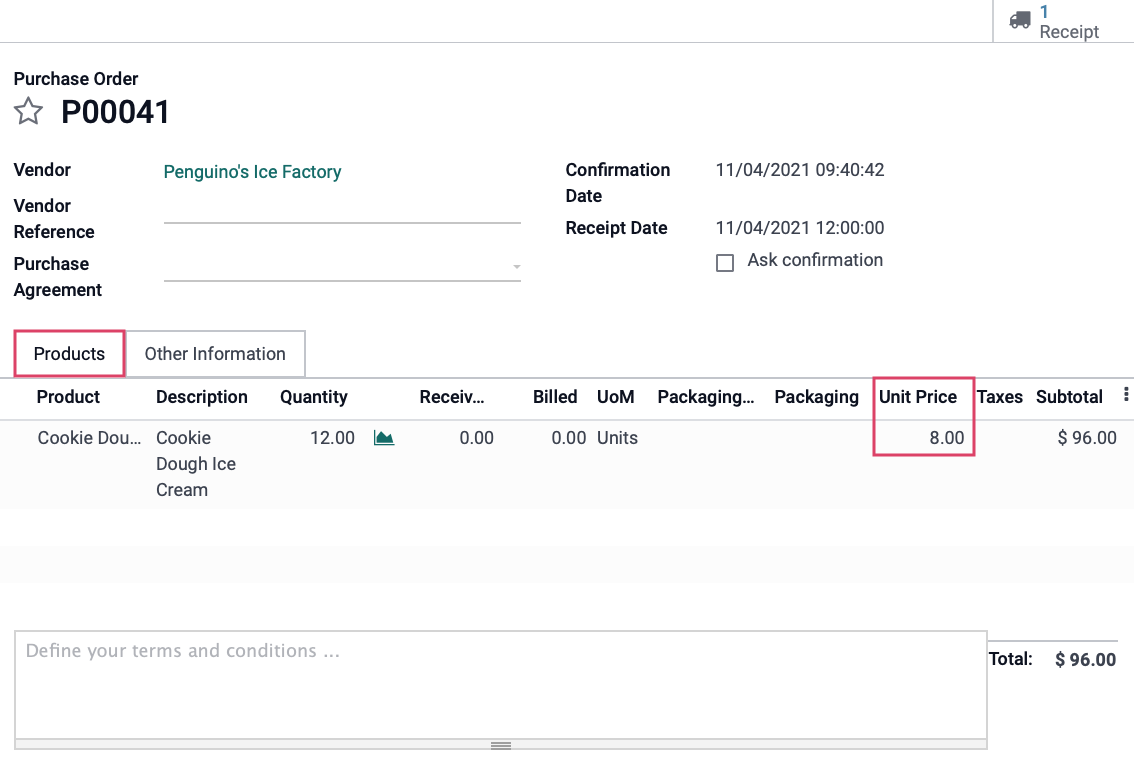

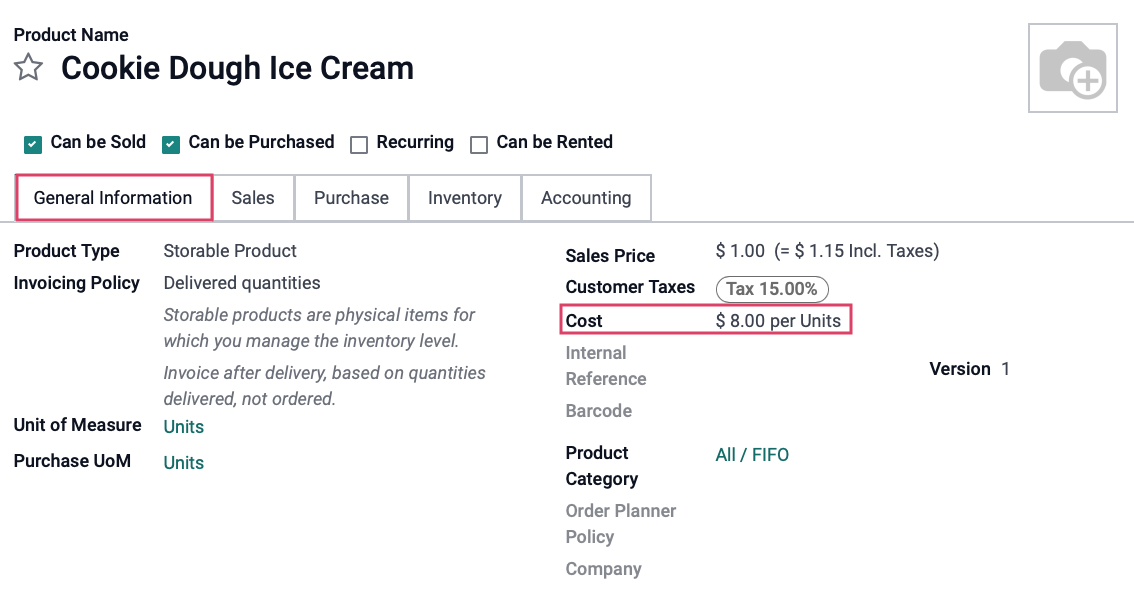

In other words, the first batch of product received was 20 products at $2.49 per unit. So to show how this example works, we have just ordered and received a second batch of 12 products at $8 per unit.

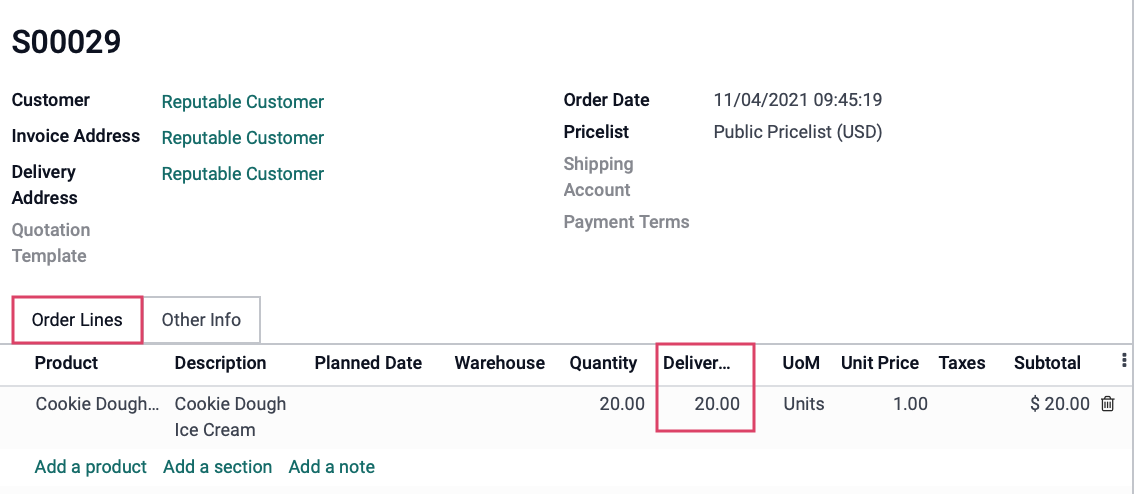

Then we created a Sales Order that will deliver 20 units of Cookie Dough Ice Cream.

What you will see here is that this order has consumed all of the products of the first batch, so when we look to our product cost again, you will see that the cost has updated to match the unit price in the Purchase Order of the second batch of received products.

To Learn more about Costing Methods, please check out our Costing Methods documentation.