Employees: Employees: Contracts

Purpose

The purpose of this documentation is to outline the use and processes associated with setting up and maintaining employee contracts in the Employees application of Odoo 14.

Good to Know!

Hibou Modules

Hibou Modules

This documentation includes the installation and configuration of the Hibou module "United States of America - Payroll with Accounting". This module will not be available on standard Odoo installations, but it can be downloaded here.

Getting Started

The first step is to install Employee Contracts. To do so, navigate to the Apps application.

Once there, search for the "Employee Contracts" module. If it isn't installed, you can do so by clicking the INSTALL button.

United States of America - Payroll with Accounting

United States of America - Payroll with Accounting

Next, remove the Apps filter and search for the "United States of America - Payroll with Accounting" module. If it isn't installed, you can do so by clicking the Install button.

Process

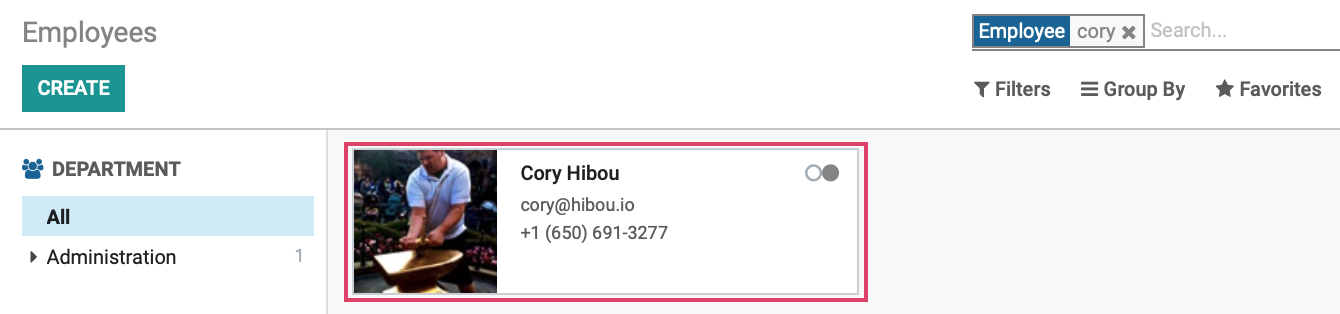

To get started, navigate to the Employees app.

Setting Up the Employee Contract

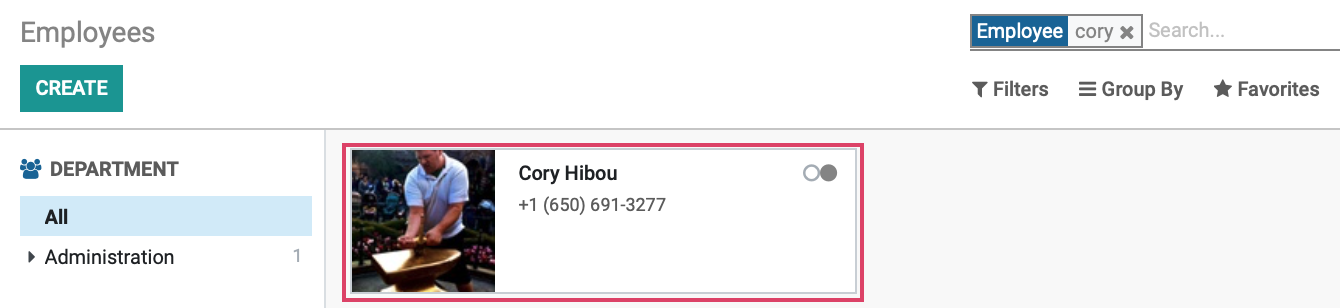

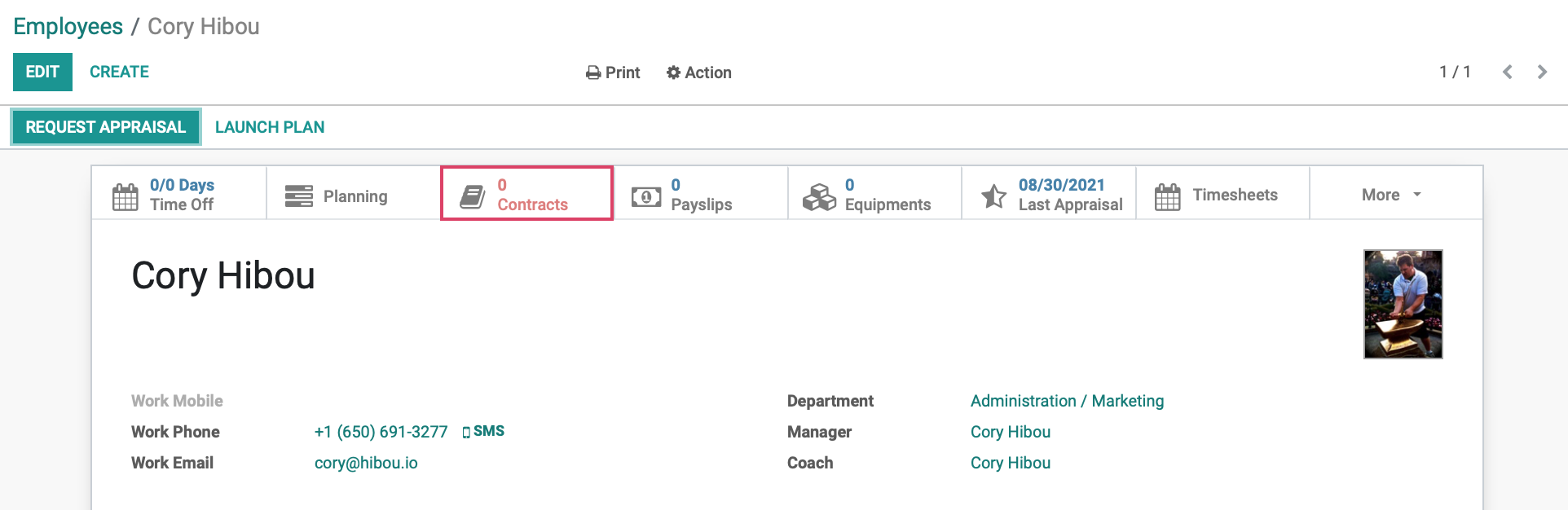

To set up a contract go to Employees > Employees, then select the employee to create the contract for. Going this route will auto-populate the employee's details into the contract form and save you some time.

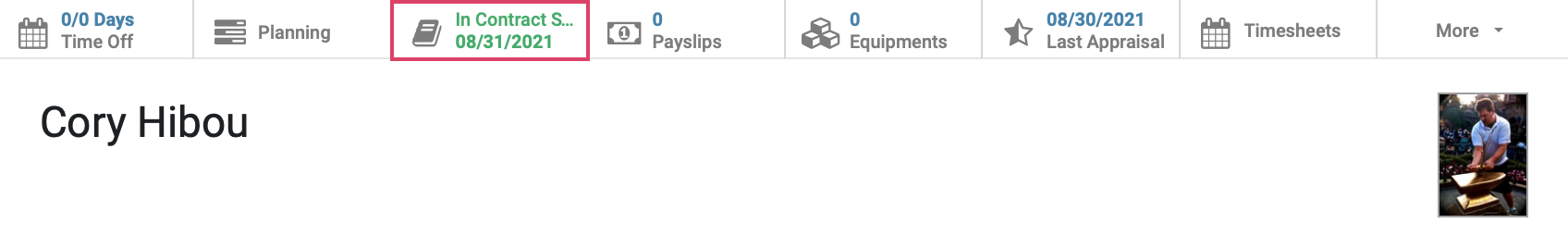

From the employee record, click the Contracts smart button.

From this page, click Create.

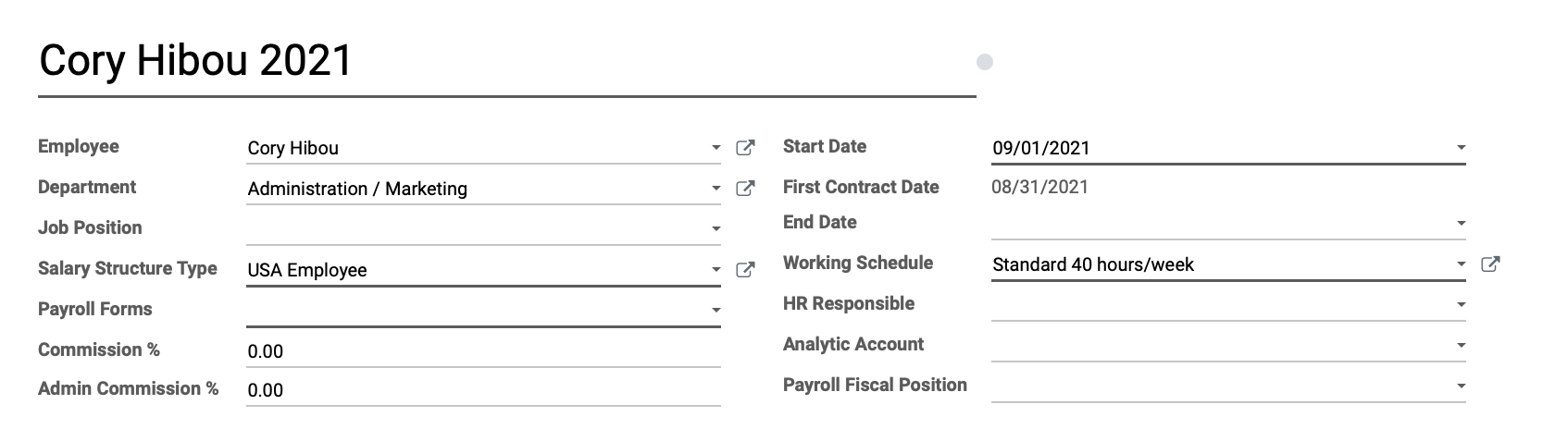

This brings you to the blank contract form. On the top section of the form, complete the following general fields:

Contract Reference: Choose a unique reference name for a specific time period. (e.g. <employee name> 20XX)

Employee: The employee's name will be populated based on the employee record.

Department: This field will be populated based on the employee record; however, you can change it or leave it blank.

Job Position: Select the employee's job position if you'd like it to appear on the contract.

Salary Structure Type: For all states in the US, select "USA Employee" from the drop-down menu. This Salary Structure Type is part of the Hibou module. It is preconfigured with data for all states. If you need assistance, please contact us.

Payroll Forms: This field is part of the Hibou module, and refers to Federal Forms 940, 941, and/or W4, and this is a required field. From the drop-down, begin typing and select CREATE AND EDIT... to create an entry for this employee. Doing so will bring up a modal window where you'll enter all applicable information, which we will cover in the section below.

Commission %: If applicable, enter commission percentage. Note that this, and the following, field is added with the installation of the Hibou Commissions module.

Admin Commission %: If applicable, enter commission percentage for Admin.

Start Date: Enter the beginning date for the contract term.

First Contract Date: This field is not editable and auto-fills based on the date the contract is created.

End Date: If this is a fixed-term contract, enter the ending date for the contract term.

Working Schedule: Select the employee's working schedule.

HR Responsible: Select the person responsible for validating the employee's contracts.

Analytic Account: Not required, but can be used to assign a project to this contract.

Payroll Fiscal Position: Used to map accounts while processing payment slips.

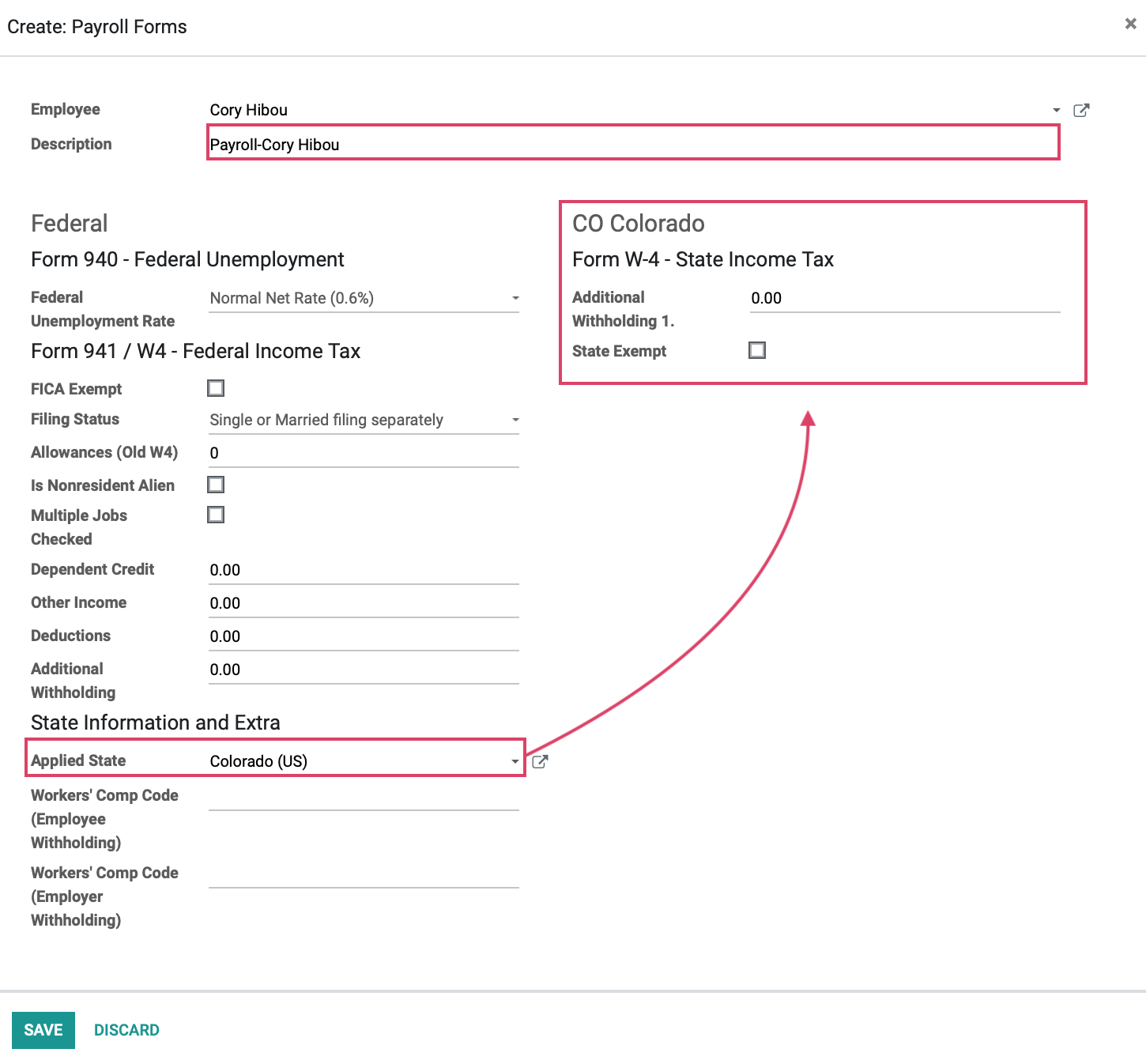

Creating Payroll Forms

This section covers portions that are part of the Hibou module.

Employee: The employee's name will be populated based on the employee record.

Description: Enter a short name for this form as this is what will appear in the drop-down options on the previous page. (e.g. Paul Williams Payroll Forms)

Federal

Federal Unemployment Rate: This will be auto-populated based on federal data. Verify the unemployment rate entered.

Form 941 / W4 - Federal Income Tax: Fill out each field with the employee's provided information.

FICA Exempt: Select if the employee is exempt from social security and medicare withholding (eg. F1 student visa, ex-patriot, etc.).

Filing Status: Select federal income tax filing status per employee's most current W4.

Allowances (Old W4): Enter the number of allowances per employee's most current W4.

Is Nonresident Alien: Select if appropriate.

Multiple Jobs Checked: Select if the employee has indicated they work multiple jobs.

Dependent Credit: Enter the calculated dollar amount for tax credit for dependants.

Other Income: Enter the calculated dollar amount for other Income.

Deductions: Enter the calculated dollar amount for deductions.

Additional Withholding: Enter the calculated dollar amount of additional withholding per employee's most current W4.

State Information and Extra

Applied State: Select the Employee's state in the dropdown menu, and further form fields may appear. Complete those fields with information from the employee's state-specific withholding forms.

For more information on US State Filing, please refer to our USA State Payroll Rates + Resources documentation.

When all information has been entered, click SAVE. This will bring you back to the employee's contract from where you'll continue entering information.

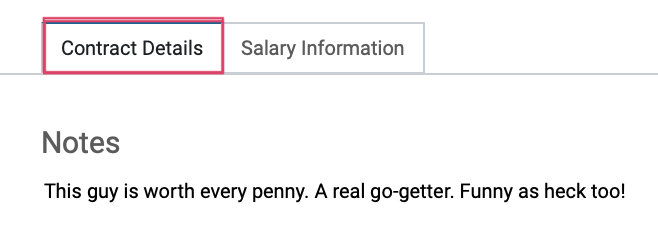

Returning to the employee contract, under the Contract Details tab:

Notes: Enter any other applicable information.

Good to Know!

Contracts typically cover a period ending when salary reviews/re-negotiations are performed.

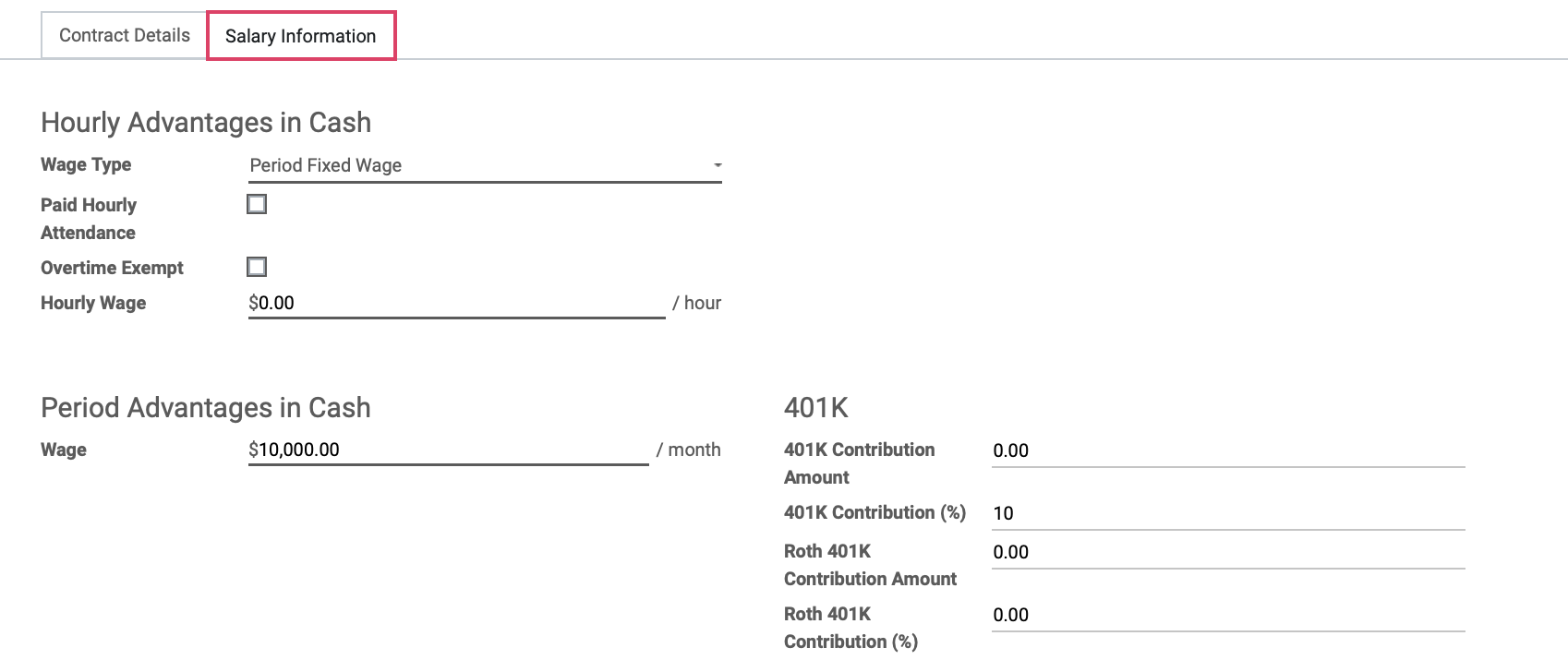

Under the SALARY INFORMATION tab:

Monthly Advantages in Cash

Wage Type: Indicates the type of wage or salary (e.g. fixed or hourly). This is determined in the Salary Structure Type.

Paid Hourly Attendance: Select if the employee is paid for hours worked.

Overtime Exempt: Select if the employee is exempt from overtime pay.

Hourly Wage: Enter employee's hourly wage.

Period Advantages in Cash

Wage: Enter employee's monthly salary.

401K

401K Contribution Amount: Enter the pre-tax amount.

401K Contribution (%): Enter pre-tax percentage amount.

Roth 401K Contribution Amount: Enter the pre-tax amount.

Roth 401K Contribution (%): Enter pre-tax percentage amount.

When all details for this employee's contract have been entered, click SAVE.

Activating an Employee Contract

By default, a newly created contract is in New status (i.e. draft). To activate their contract, click RUNNING from the stages on the right.

Good to know!

New/draft contracts will not be active, therefore it is important to move the contract to the RUNNING state.

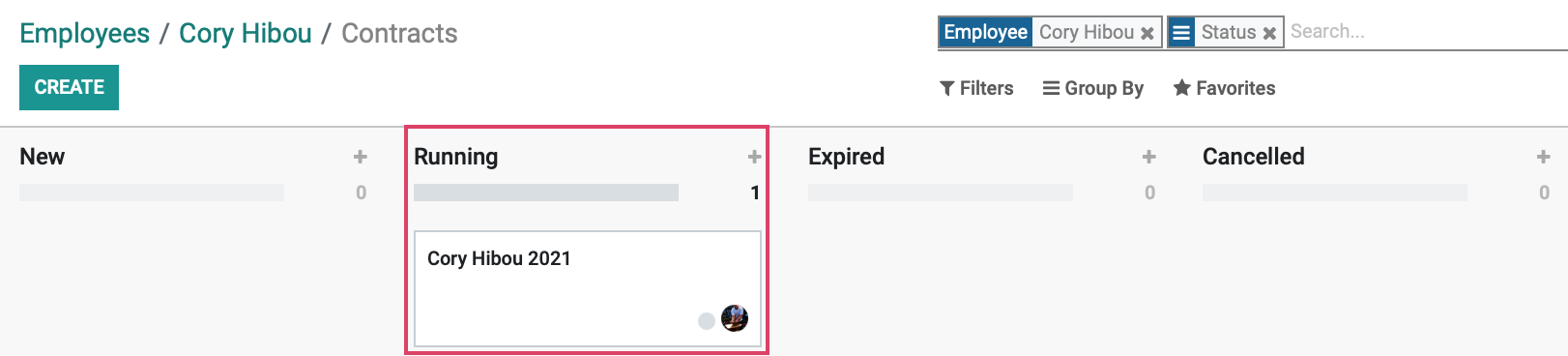

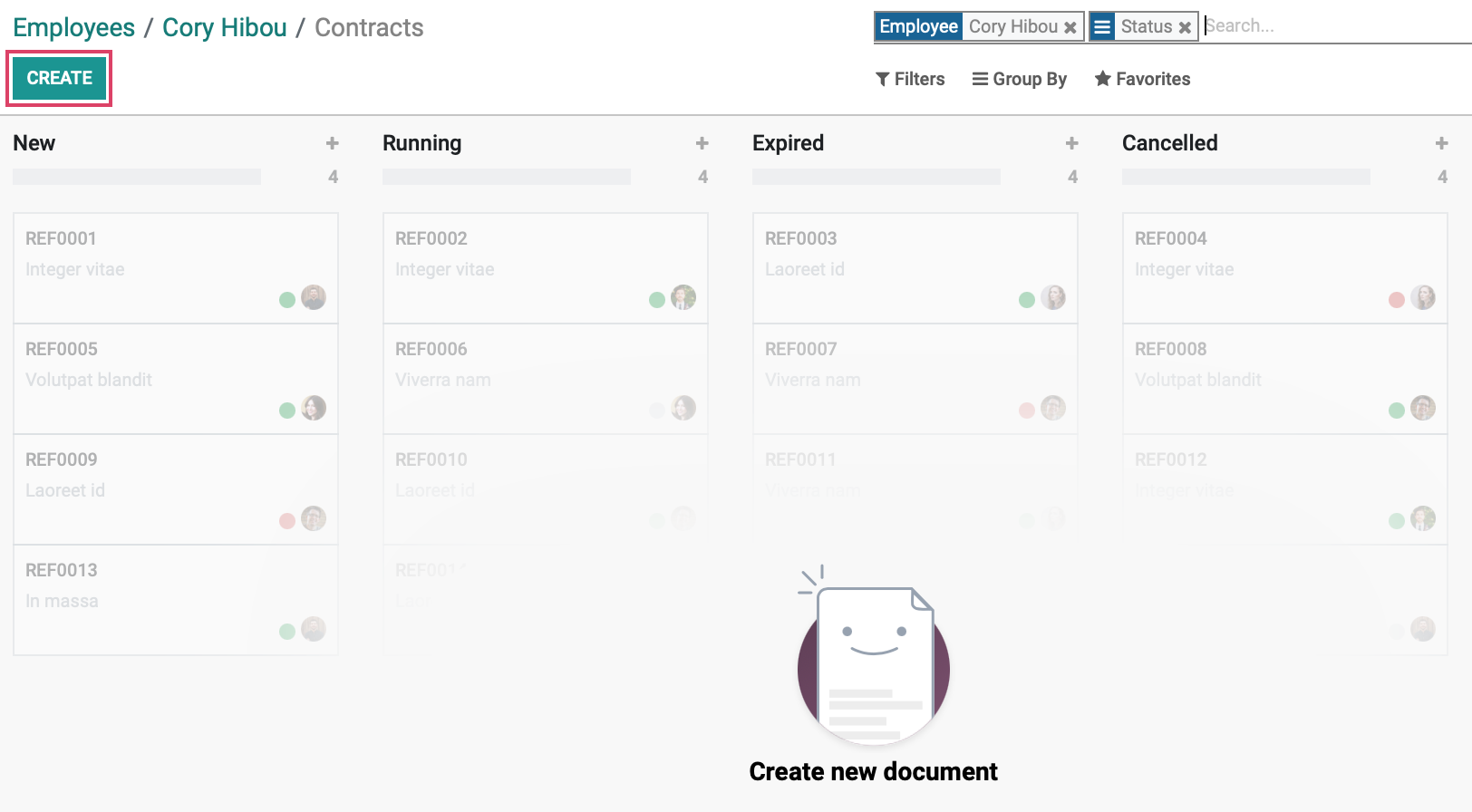

Verify Contract Status

To verify the status of an employee contract, go to Employees > Employees and select the employee whose contract you'd like to verify.

Once there, click the Contracts smart button.

This employee's contract will be listed under one of the four status columns.

Aside from Running, the available statuses are:

New: Newly created Contract. In this status, the Payroll application will not use this Contract to calculate a Payslip.

Expired: A Contract that has reached its End Date. In this status, the Payroll application will not use this Contract to calculate a Payslip.

Cancelled: Contracts that have been marked Cancelled before its End Date.