Payroll: Payroll Configuration

Purpose

The purpose of this documentation is to outline the use case and processes associated with setting up and maintaining the Payroll application.

Configuration includes:

Settings: Set up payroll localizations and Accounting functionalities.

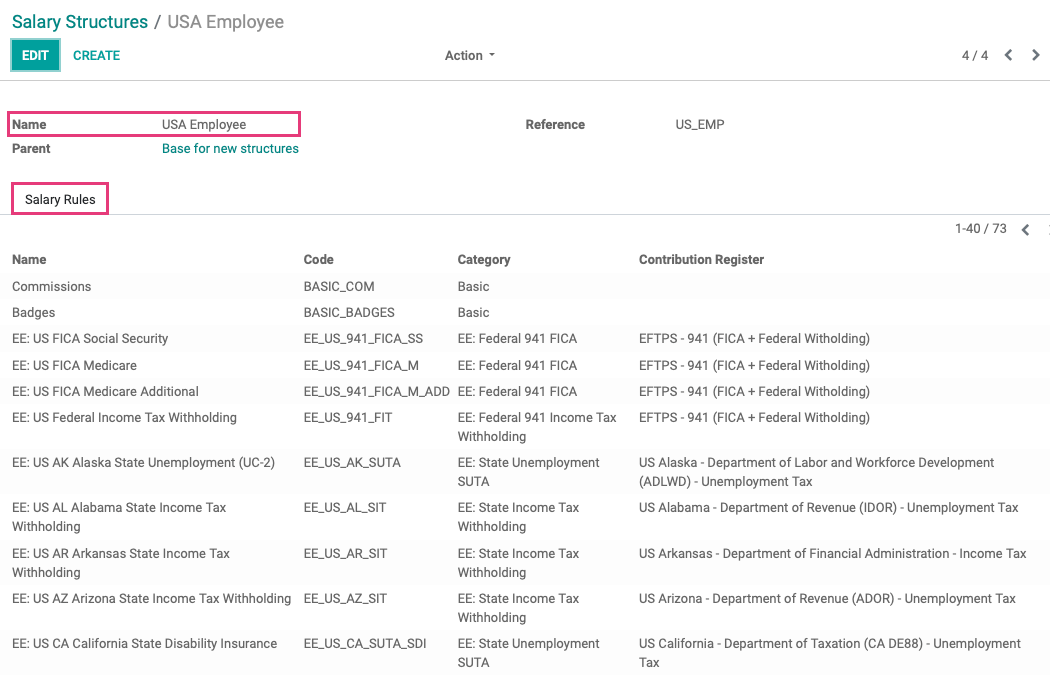

Salary Structures: View Salary Structures, the localized constructions that contain Salary Rules.

Salary Rules: View Rules, the lines that appear on payslips and indicate an input or output.

Other Input Types: Create a new input type that will appear on the payslip.

Good to Know!

The payroll information outlined in this document uses the following Hibou Odoo Suite modules:

USA - Payroll: Contains the US Federal and State localizations for payroll in the United States.

Payroll Accounting: This module integrates the Payroll app with the Accounting app.

You will require these modules in order to run Payroll in the U.S., as Odoo does not come pre-loaded with salary rules or conditions. In this document, we will cover the installation of these modules.

To get started, navigate to the Payroll application.

Setting Up Payroll

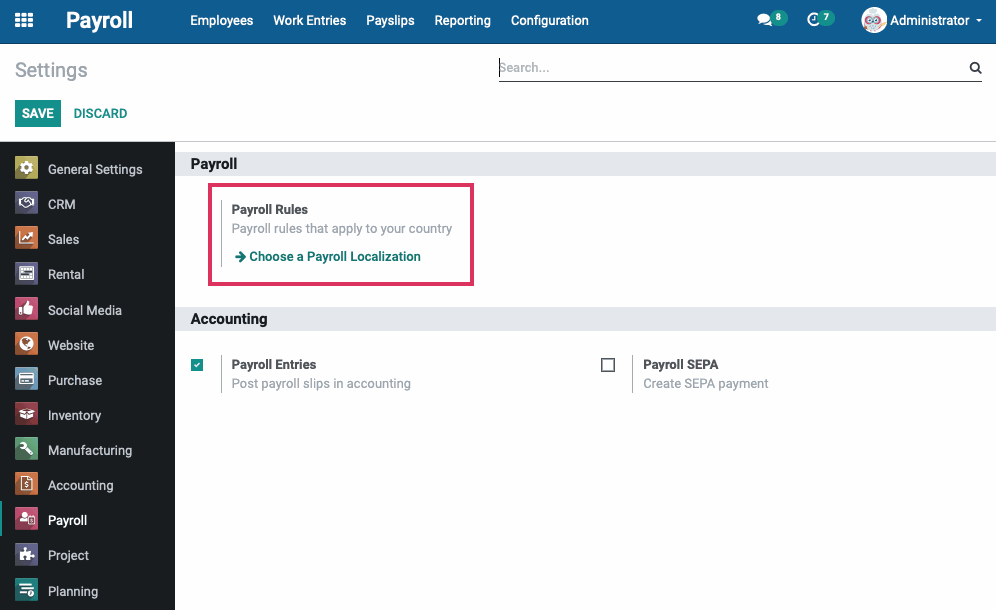

Go to CONFIGURATION > SETTINGS.

Under Payroll, click on Choose a Payroll Localization.

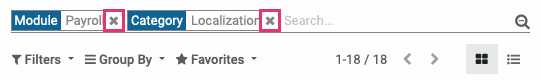

On the next screen, remove the Payroll and Localization filters from the search box.

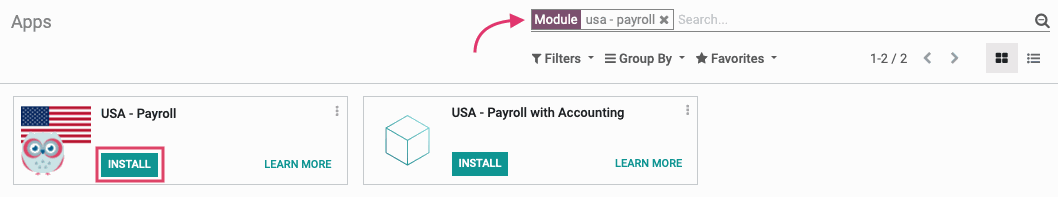

In the search field, search for the "USA - Payroll" module. If it isn't installed, you can do so by clicking the INSTALL button.

Good to Know!

If you need to install any of these modules, you'll be taken to Odoo's main menu immediately afterward and will need to navigate back to the Configuration > Settings section in Payroll again. Alternatively, you can install these modules using the Apps application.

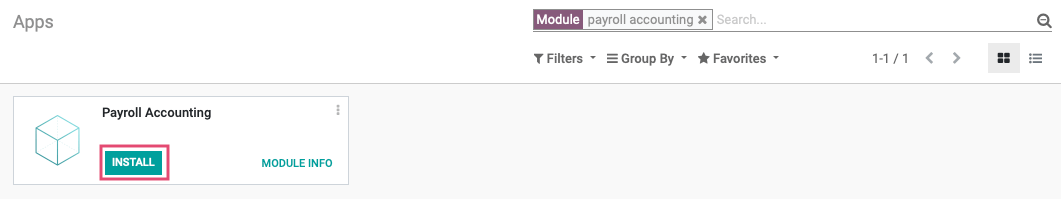

Payroll Accounting

Search for the "Payroll Accounting" module. If it isn't installed, you can do so by clicking the INSTALL button.

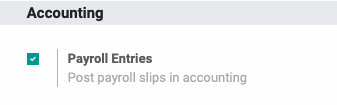

If you're not already in the Payroll application, go there now and click CONFIGURATION > SETTINGS. In the settings under Accounting, you will find the following options:

Payroll Entries: If you select this, payroll slip amounts will be posted in the Accounting app.

Enable Payroll Entries, then click Save.

Salary Structures

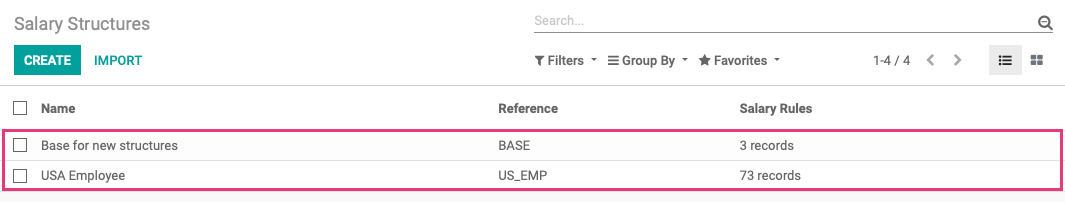

Go to CONFIGURATION > salary structures.

Salary Structures are used to determine an employee's compensation. You will typically require one or more salary structures for your employees depending on where they live and work.

Please contact us if you need more salary structures.

NOTE: The USA - Payroll module is preconfigured with basic Salary Structures for US Payroll.

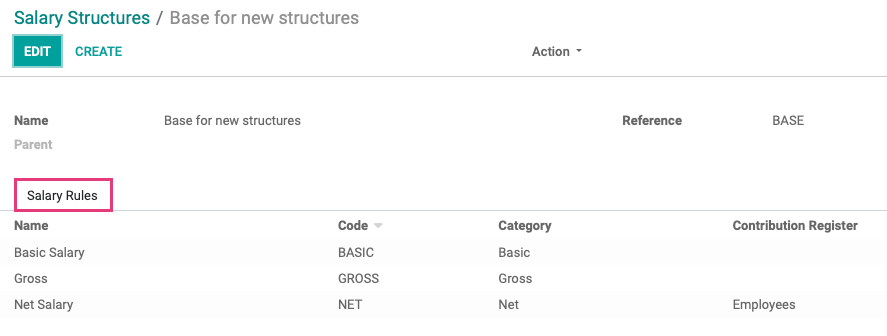

Select the Base for new structures entry to see the available options on a Salary Structure template. By default, it contains the following rules:

Basic Salary (base pay)

Gross (taxable income)

Net Salary

Use the breadcrumbs to navigate back to Salary Structures.

Next, click into the USA Employee Salary Structure to see how Hibou has preconfigured the template.

Under the Salary Rules tab, find a list of Rules for each state you run payroll for.

NOTE: The Hibou USA - Payroll module is preconfigured with basic Salary Rules for US Payroll.

Salary Rules

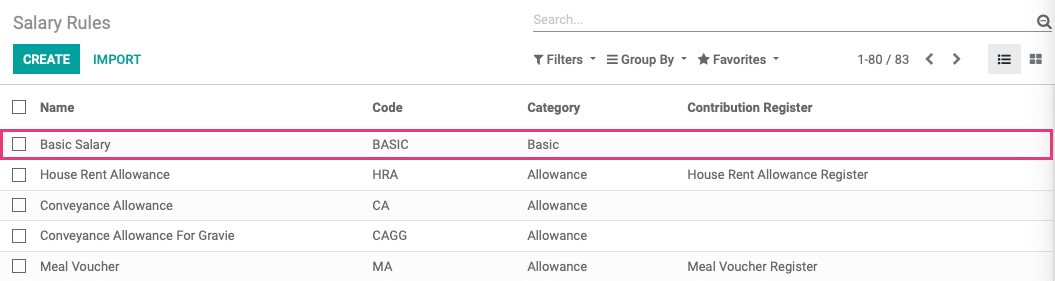

Go to CONFIGURATION > salary Rules to see all existing salary rules.

Salary Rules are conditions that apply to a Salary Structure, such as computation of amounts, designation of general ledger accounts for the Accounting app, Python code, and more.

To review the Salary Rules configuration, click Basic Salary, then click EDIT.

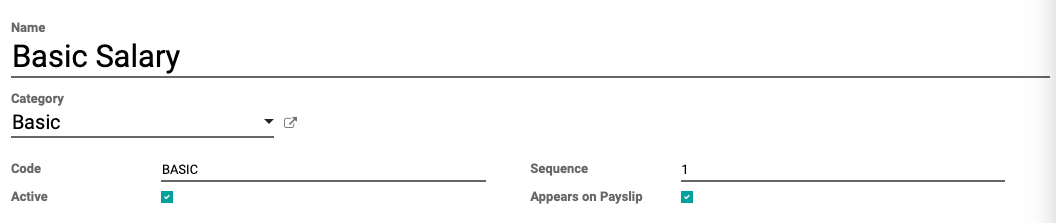

You will see the following fields:

Name: A unique but identifiable name for the rule.

Category: Select the appropriate category.

Code: Can be used as a reference in the computation of other rules. In that case, it is case sensitive.

Sequence: Use to arrange a calculation sequence. For example, a 401K contribution should have a lower sequence number than Gross Wages, while Taxes would have a higher sequence number than Gross Wages.

Active: Disabling this field will allow you to hide the salary rule without deleting it.

Appears on Payslip: Use to display salary rule on payslip.

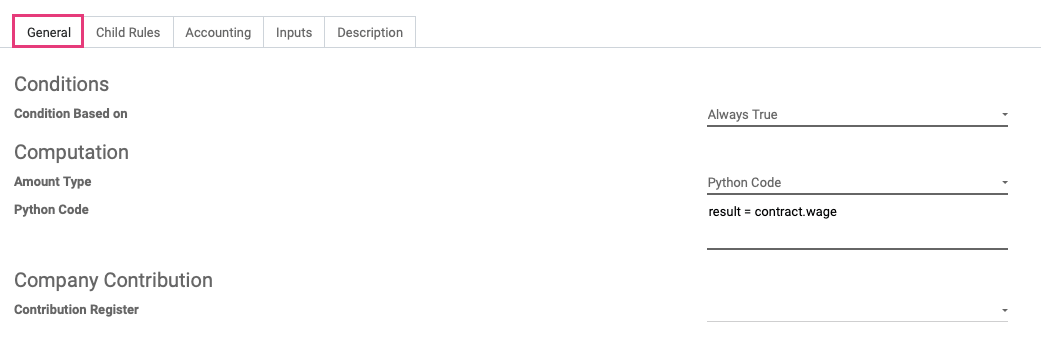

In theGeneral tab:

Conditions

Condition Based on: Condition on which the rule is based (Always True, Range, or Python Expression). If you choose Range or Python Expression, other fields will become available for setting the conditions. Hibou creates these for its pre-loaded rules and provides them in the module.

Computation

Amount Type: Computation for the rule amount.

Python Code (only available if Amount Type is set to Python Code): Input Python code for the salary rule calculation.

Company Contribution

Contribution Register: Indicates the eventual third-party involved in the salary payment of the employees.

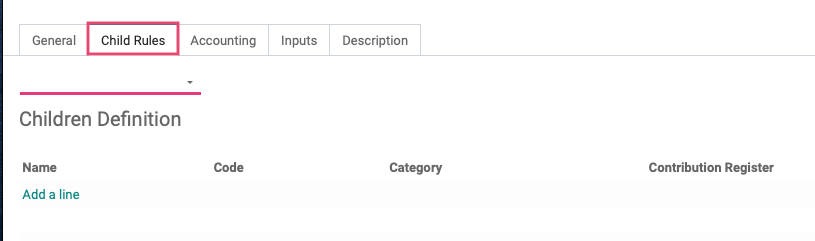

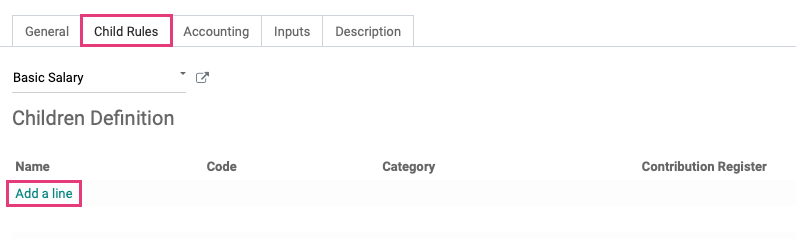

Use the Child Rules tab to create rules that are dependent on the parent rules indicated from the General tab.

To add a new Child Rule, first, select a parent rule from the dropdown:

Next, click Add a Line to add subsequent rules.

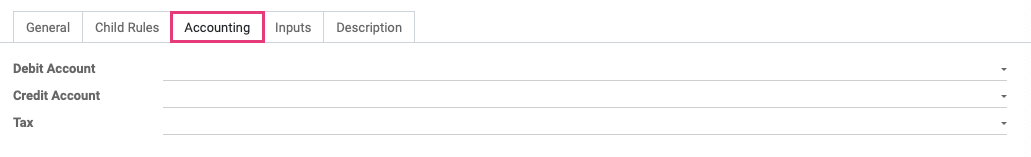

On the Accounting tab, you have the option to specify the following:

Debit Account: Select the account the salary will be debited to.

Credit Account: Select the account the salary will be credited to.

Tax: Select the tax to be applied.

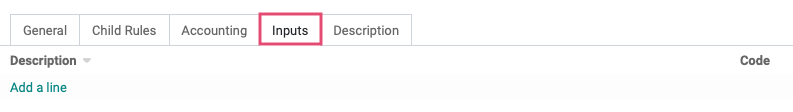

The fields on the Inputs tab are for advanced use with Python code. If you need assistance adding additional input fields for your Salary Rule, please contact us.

On the Description tab, use the freeform to write a more detailed description of the rule.

Once everything is filled in, you can click SAVE & CLOSE if you're done or click SAVE & NEW to create an additional Salary Rule.

Good to Know!

Example of proper uses of Debit and Credit accounts:

Basic Salary: Debit salary expense

Basic Bonus: Debit salary expense

Net Salary: Credit accounts payable or a payables account specifically for employee payables (example: Employee Net Payable).

EE: US FICA or Federal Income Tax W/H: Debit accounts payable (since the amounts are negative numbers on the payslips, by selecting the debit account, the number will be posted as a credit in accounts payable).

ER: US FICA, state unemployment or Federal Income Tax W/H: Debit accounts payable and credit a salary expense, such as Salary FUTA Expense, Salary FICA Expense or Salary SUTA Expense. Both fields are filled out as it is paid by the company.

Gross, Wage: US FICA, FUTA, or state unemployment: No accounts selected