USA State Payroll Rates + Resources: State of Ohio: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Ohio. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Ohio's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Register for Tax Withholding Account

All business taxpayers must be registered with the Ohio Department of Taxation. The department offers the following three methods to accomplish this:

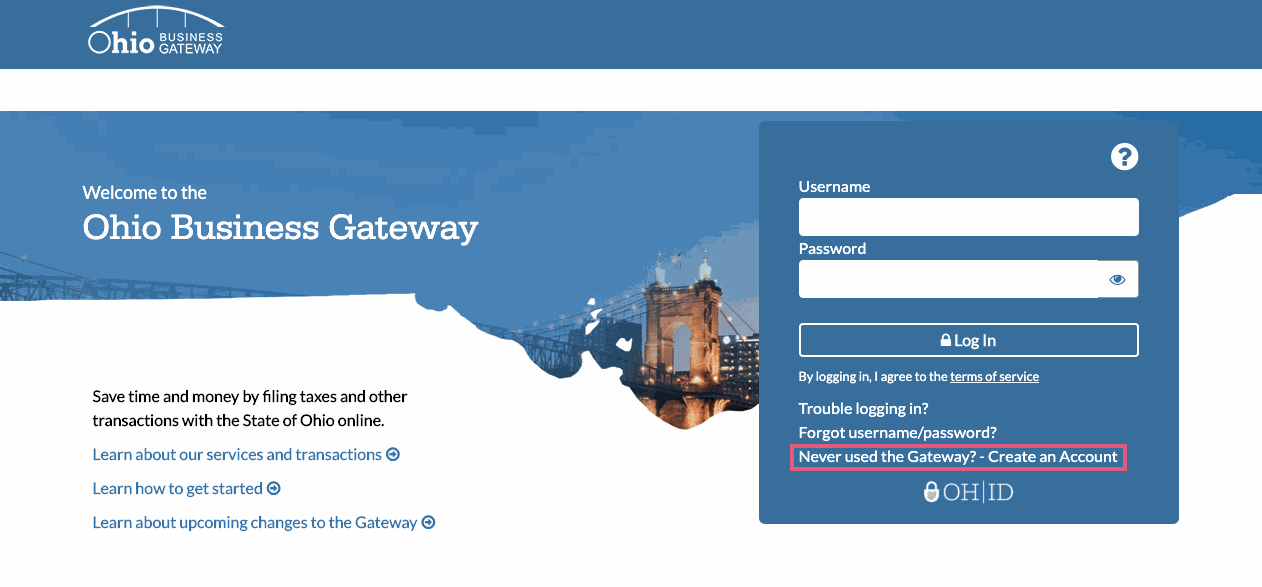

Ohio Business Gateway: The Gateway is the most comprehensive business online service available in Ohio. Taxpayers can electronically register for employer withholding and unemployment compensation, workers' compensation, and municipal income taxes for nearly 500 cities and villages. Filing and payment can also be done through the Gateway. You will be asked to designate a contact person and to list the name and job title of the person who will be reporting the tax information. Once registered, you can start filing your returns immediately.

Once on the website, click on "Never used the Gateway? - Create an Account".

Telephone: Limited registration is available from the department by telephone. Employer Withholding accounts (IT-1) may be registered by calling (888) 405-4089.

By Mail: Complete form IT 1 Application for Registration as an Ohio Withholding Agent and mail to the addresss below. Please note that this method can take up to 6 weeks to process.

Ohio Department of Taxation

P.O. Box 182215

Columbus, OH 43218-2215

Good to Know!

If you have registered for an employer withholding account, you do not need to register separately for school district withholding. Employers use the same account number for both employer and school district withholding.

Register for Employer Unemployment Compensation Account

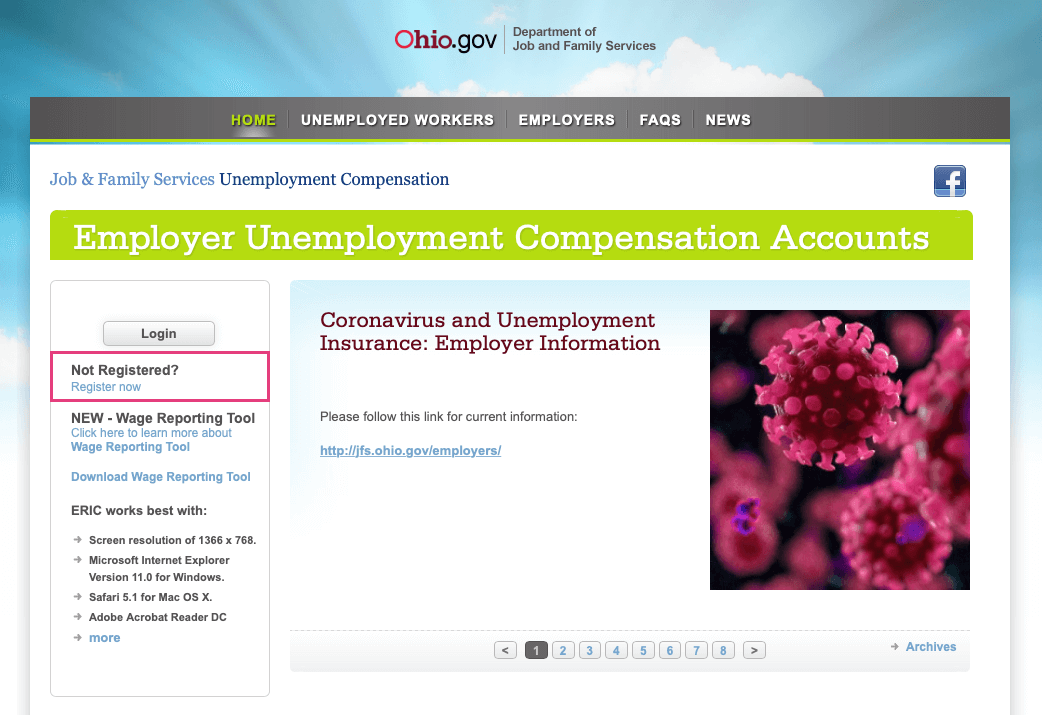

New employers may register for an Employer Unemployment Compensation Account through the Employer Resource Information Center (ERIC). To create an account, click the Register Now link.

For more information, download the Employer's Guide to Ohio Unemployment Insurance.