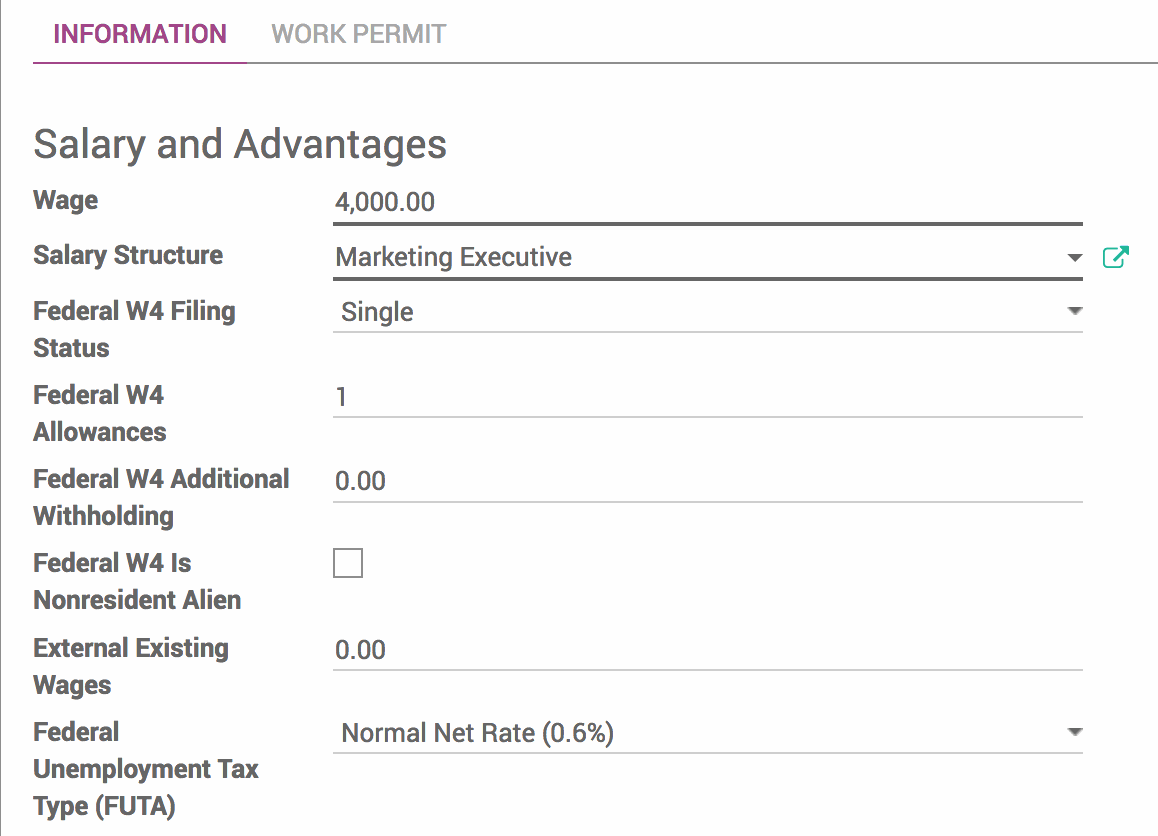

Non-Resident Alien (W4)

New Contract level field for withholding calculations based on Non-Resident Alien status. This field only affects Federal Income Tax withholding.

Additional Withholding (W4)

New Contract level field for employees that desired additional wages to be withheld for their income taxes. This field only affects Federal Income Tax withholding.

External Existing Wages

New Contract level field to assist in the migration mid-year to a new Payroll system. Filling this field in with an amount indicates that any tax that has wage caps (e.g. FUTA) should use this amount as a starting amount.

E.g. If an employee is paid $5000 per period, and you put 5000.00 into the External Wage box, the next payslip will have $2000 of FUTA wages.

Federal Unemployment Tax Type (FUTA Type)

New Contract level field to determine the rate for FUTA withholding. In general, if you pay a State Unemployment Tax/Insurance, you can leave this at the normal net rate of 0.6%. If your employees are exempt from State Unemployment Tax, this should be set to the basic rate of 6%

Bear in mind that the displayed rates are for your convenience, and in fact calculated for the year/period they pertain to. State unemployment rates should be disabled if the FUTA rate type is 'Basic'.

Future

In the near future I will start releasing State specific taxes, and these changes will make some of that work better and more sustainable.

Stay tuned, and subscribe for Payroll notifications